https://www.cnn.com/2019/08/25/entertainment/quavo-migos-popeyes-chicken-sandwich-trnd/index.html

2019-08-25 22:44:00Z

52780362809644

Tofurky wasn’t keeping cattle ranchers awake at night.

For decades, veggie burgers were the token offering to vegans at the backyard barbecue, and Tofurky was the Thanksgiving benediction to the meat-free loved ones in our lives.

But as plant-based meat goes from an afterthought to a financial juggernaut that aims to change how most people eat, the opposition has suddenly awakened: Many of the country’s 800,000 cattle ranchers have declared war on newcomers Impossible Foods and Beyond Meat, which use technology to make products that hew closely to the taste and texture of meat, and now “first-generation” veggie burgers and similar products are caught in the crossfire.

In 2019, officials in nearly 30 states have proposed bills to prohibit companies from using words such as meat, burger, sausage, jerky or hot dog unless the product came from an animal that was born, raised and slaughtered in a traditional way. Arkansas, Louisiana, Mississippi, North Dakota, South Dakota, Oklahoma and Wyoming have already enacted such laws. In Missouri, the first state where the ban took effect, violators incur a $1,000 fine and as much as a year in prison. Mississippi’s new law is sweeping: “Any food product containing cell-cultured animal tissue or plant-based or insect-based food shall not be labeled meat or as a meat product.”

The states, in most cases backed by cattlemen’s associations, claim consumer confusion as the driving force for the laws. The newest offerings, they say, cross a line when they make unsubstantiated health claims (many have long lists of processed ingredients and are high in sodium) and when the packaging is unclear.

“Beyond Meat Beefy Crumbles has a picture of a cow on the front and says ‘plant-based’ in very small lettering at the bottom,” said Mike Deering, a cattle rancher and the executive vice president of the Missouri Cattlemen’s Association. “I’m a dad and I’m going through the grocery store before one of my boys has a meltdown, and [if] I pick up that package that says beef with a picture of a cow on it, I’m going to buy it.”

This isn’t quite a David vs. Goliath fight. The cattle associations have enormous political power, and several of the top veggie brands such as Morningstar Farms and Boca are owned by food giants such as Kellogg and Kraft Heinz. Notably, the major meat processors — Tyson Foods and Smithfield Foods, for instance — aren’t taking sides, relying on the ranchers for traditional meat but also investing heavily in these new alternatives they believe consumers increasingly desire.

The future of ranching faces a big threat if plant-based meat, thought to be much better for the environment, becomes a mainstay of the American diet.

Traditional animal agriculture is looking to the lessons learned by the dairy industry, which saw cow’s milk sales dwindle by $1.1 billion last year, much of that business scooped up by alternative milks such as almond and oat. And as the stock price of Beyond Meat, which went public this year, has soared, some of the biggest retailers and restaurants in America have got on board with plant-based alternatives.

[In a crowded field of big-name IPOs, Beyond Meat emerges as the surprise MVP]

In September, Impossible Burgers roll out in grocery stores. Subway has announced meatless meatballs, Carl’s Jr. and sister company Hardee’s have gotten on the meatless meat wagon, Dunkin’ introduced its Beyond Sausage breakfast sandwich and Burger King expanded the reach of its Impossible Whopper to all franchises.

On July 22, Tofurky joined forces with the American Civil Liberties Union, the Good Food Institute (a nonprofit that promotes plant-based meat) and the Animal Legal Defense Fund to file a lawsuit claiming Arkansas’ new labeling law, which went into effect July 24, violates the First and Fourteenth amendments.

“If we lose, there’s something wrong with our judicial system,” said Tofurky chief executive Jaime Athos. “The first thing to get out of the way is that people are confused. It’s all [the cattlemen’s associations] can come up with to censor speech.”

[One thing might keep the Impossible Burger from saving the planet: Steak]

He said there is mandatory court-ordered mediation because the two sides have failed to reach an agreement. If Tofurky loses, plant-based meats will have to be repackaged to reflect approved nomenclature, an expensive endeavor for a national company that sells to all 50 states. The bigger issue, Athos said, should focus on the emerging science about the benefits of a plant-based diet.

“The meat industry’s chickens are coming home to roost. Their industry was propped up by agricultural subsidies and misrepresented the true nutritional value and necessity of meat in the American diet,” he said. “We know better. These are not healthy things.”

Despite being dragged into the fight, Athos said he’s not miffed at what’s transpired.

“When it comes down to it, we’ve undertaken a monumental task and we now have partners to help us achieve those goals,” he said. “What a great thing to be able to live your values. What we’re seeing with plant-based is the conversation shifting from ‘why’ to ‘why not.’ ”

[From lab to table: Will cell-cultured meat win over Americans?]

There are reasons for Athos to be sanguine. Tofurky has seen year-over-year double-digit growth that has been limited only by production capacity, he said.

“There’s no question we’re seeing more attention to the category,” said Michele Simon, executive director of the Plant Based Food Association, which advocates for the leading plant-based food companies. “ … To have a company like Tofurky have an easy time talking to Walmart? This wasn’t the case five or 10 years ago.”

Morningstar Farms, which has been around for more than 40 years, has shifted from being just in grocery stores to being in restaurants, universities, schools, cafeterias and hospitals, with nearly 25,000 locations and with 7,500 new restaurants projected by 2020.

While parent company Kellogg doesn’t disclose specific sales data, it issued a statement saying the plant-based surge led by Impossible and Beyond has been beneficial, driving more consumers to meat alternatives. Morningstar has announced its entire portfolio will be vegan by 2021 (plant-based cheese and egg will be added into the mix), while Boca, owned by Kraft Heinz, went through a major brand refresh with new recipes and retro-cool packaging updates in 2018.

For Jan Dutkiewicz, a postdoctoral fellow at Johns Hopkins University who teaches a class a class titled “Modernity and the Slaughter House,” these first- and second-generation plant-based companies make strange bedfellows, with widely discrepant agendas.

“Tofu and seitan have been around for centuries. These were not on the mainstream radar — the stuff hippies eat. For Tofurky and Morningstar, customers were more vegans and vegetarians, not mainstream consumers. They weren’t trying to compete with meat on taste,” he said. “Impossible and Beyond are not an outgrowth of Tofurky. Their aim is to mimic meat as closely as possible. They are trying to supplant meat entirely.”

The investment capital involved is different, too, Dutkiewicz said, “by orders of magnitude.”

Plant-based items that closely mimic meat are seen as a promising new revenue stream for most big meat and food companies. These giants are beginning to reposition themselves as “protein companies.”

Earlier this month, Smithfield Foods, the largest pork producer in the world, announced it would launch a plant-protein line under the Pure Farmland brand. Maple Plant-Based Breakfast Patties, Simply Seasoned Plant-Based Protein Starters and six other products will debut in stores in September. Tyson Foods is debuting its own meatless-protein line. Perdue has launched blended meat-and-veg chicken nuggets, tenders and patties. Nestlé is rolling out a plant-based line, and Hormel’s Applegate has debuted blended meat-and-mushroom burgers.

The top item on the National Cattlemen’s Beef Association’s list of 2019 policy priorities is to hash out a regulatory framework for plant-based and cell-based meat, a responsibility that will slide back and forth between the Food and Drug Administration and the U.S. Department of Agriculture.

According to Deering, some of the hubbub really relates to the anticipated launch next year of cell-based meat, that is meat, poultry and seafood products derived from muscle tissue grown in a lab with cells harvested from a living animal. Ranchers fear that insufficient labeling will not distinguish between traditional animal agriculture and these products that do not yet have a track record for safety and human health.

“We are at the mercy of the market, at the mercy of the weather,” Deering said. “We represent some of the most resilient people on the planet who can compete any day of the week and twice on Sunday. This is about consumer protection.”

Also earlier this month, the Center for Consumer Freedom (CCF), a nonprofit that lobbies on behalf of the fast food, meat, alcohol and tobacco industries, placed ads in the Wall Street Journal and New York Post highlighting many of the ingredients in fake bacon and fake sausage, pointing out that many of the plant-based meat options are highly processed and suggesting this might fly in the face of what folks think of as “healthy.”

“People see veggie burgers on the menu and think it sounds like it’s chopped-up salad,” said Will Coggin, managing director of CCF. “Despite what the name leads people to believe, ‘plant-based’ meats are made in industrial facilities, not gardens. Fake meat companies are trying to promote a ‘health halo’ over their products, but consumers should know that imitation meat is highly processed and in some cases has more calories and sodium than the real thing.”

If there is a U.S. recession on the near-term horizon, it’s not yet appearing in any form in the drive-thrus at fast-food giant Restaurant Brands International (QSR).

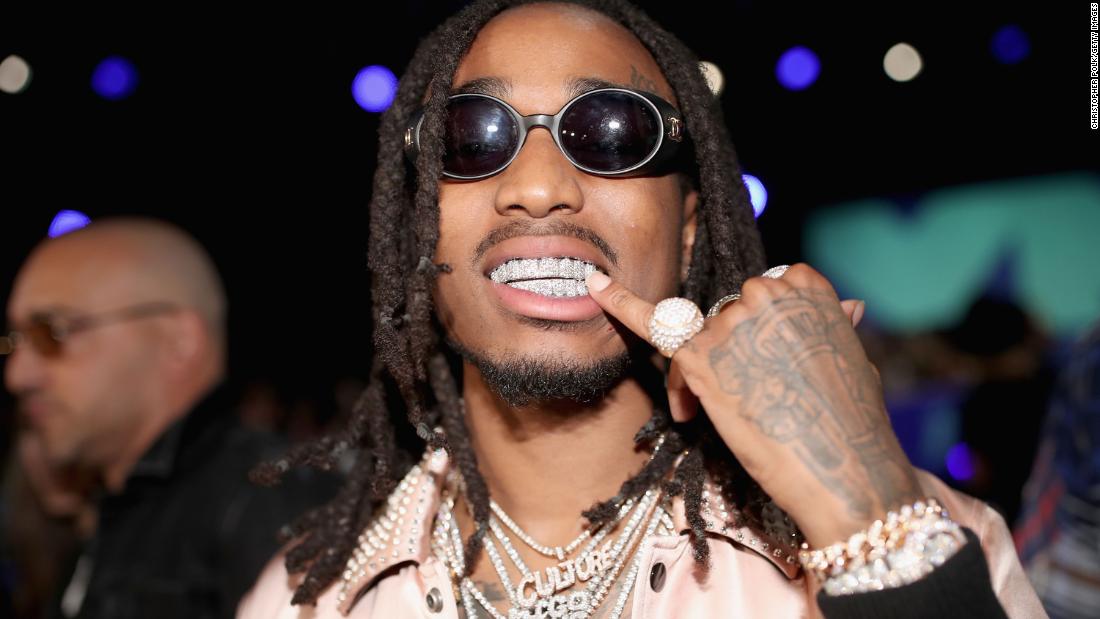

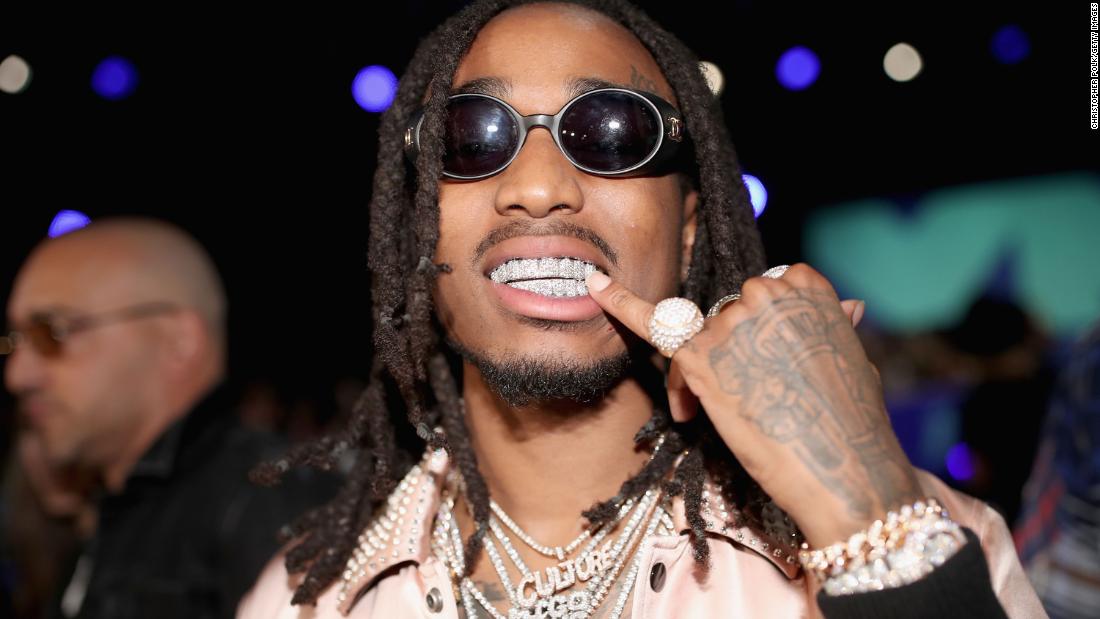

The owner of Burger King, Popeyes Louisiana Kitchen and Tim Horton’s continues to score notable successes with new, higher priced menu items. That includes the new $4.99 (pre-tax) Popeyes fried chicken sandwich, which has blown up on Twitter as hardcore eaters voice their views on who has the best fried chicken sandwich in the fast-food game (Chick-Fil-A or Wendy’s). Restaurant Brands CEO José Cil told Yahoo Finance — in not so many words — the strong consumer response on social media has translated into impressive sales of the sandwich since its August 12 release.

Burger King’s new plant-based Impossible Foods Whopper — priced around $6 — has been so hot the chain is having a hard time keeping it in stock, Cil suggested.

“If we deliver great food, great experiences and great looking restaurants I think what happens at a macro [economic] level is less impactful at our restaurants. I have seen great businesses do poorly in up economies and smaller businesses do really well in bad economies,” Cil says.

All in all, if consumers were fearful of losing their gigs — these higher priced menu items at Restaurant Brands probably wouldn’t be selling that well. Instead, folks would be opting to eat at home to save money — similar to behavior seen during the 2008-2009 financial crisis. Cil says he hasn’t seen any cooling in sales at the company’s thousands of U.S. stores.

Restaurant Brands’ financials back up Cil’s claims. Popeyes and Burger King saw 2.9% and 0.5%, respective increases, in U.S. same-store sales during the second quarter. Considering how competitive the fast-food industry is — and Restaurant Brands not being a major player in the key breakfast hours like rival McDonald’s —the sales were better than average.

Investors appreciate Cil’s push into more premium products, even though Cil acknowledged on the company’s second-quarter earnings call this month Burger King could use a few more entry level foods (such as the new $1 taco). Restaurant Brands stock is up a cool 46% this year, about three times more than the S&P 500 (^GSPC). McDonald’s and Wendy’s shares have gained 21% and 35%, respectively, year-to-date.

“We are confident in long-term growth with international network of master franchisees. Menu innovation at Burger King U.S. and innovation/digital enhancements at Tim Horton’s Canada should support same-store sales acceleration,” wrote Credit Suisse analyst Lauren Silberman in a recent note to clients.

See you at the drive-thru.

Yahoo Finance’s Myles Udland contributed to this story.

Brian Sozzi is an editor-at-large and co-host of The First Trade at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read the latest financial and business news from Yahoo Finance

Why Target is shocking everyone and putting Amazon on notice

Why Macy's should rattle investors by cutting its big dividend

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

U.S. stocks fell in a volatile session of trading, after President Donald Trump wrote in a series of Twitter posts that he would be ordering U.S. companies to “immediately start looking for an alternative” to their business operations in China.

This comes after China announced during the pre-market trading session that it would be imposing tariffs on additional U.S. goods as retaliation against the Trump administration’s levies due to take effect September 1.

China’s Finance Ministry said in a statement that it would be imposing tariffs on another about $75 billion worth of U.S. goods, which will be rolled out in two batches on September 1 and December 15. The Trump administration has also previously announced some tariffs on Chinese imports would take effect September 1, while others would hit in mid-December.

Here’s where the markets settled Friday:

S&P 500 (^GSPC): -2.59%, or 75.84 points

Dow (^DJI): -2.37%, or 623.34 points

Nasdaq (^IXIC): -3.00%, or 239.62 points

10-year Treasury yield (^TNX): -8 bps to 1.53%

Less than an hour before Trump’s tweets, stocks had been positive after Federal Reserve Chair Jerome Powell called out “significant risks” to the U.S. economy and repeated a pledge to “act as appropriate to sustain the expansion.” Investors largely took this assessment to mean the Fed leader was still open to the idea of easier monetary policy in order to help keep the economy humming.

Powell’s prepared comments, delivered at Fed’s annual Jackson Hole Economic Policy Symposium, come about a month before the Federal Reserve’s next monetary policy meeting, which market participants have hoped will result in the first of several more interest rate cuts.

The Fed’s justification for the July rate cut had centered on staving off global economic risks, and boosting what has now been persistently low inflation in the U.S. With both factors still at play a month later, these may serve as the basis for yet another interest rate cut to support the domestic economy.

“It is clear from [Powell’s] speech that the single biggest factor driving both market volatility, the actual global slowdown, and fears of a U.S. slowdown, is trade policy, both its current stance and uncertainty about the future,” Ian Shepherdson, chief economist for Pantheon Macroeconomics, wrote in a note. “In other words, the Fed has been handicapped by Mr. Trump's damaging and capricious trade policy, which has made it very hard for monetary policymakers to take a settled view of where the economy is headed.”

But the market’s conviction that further rate cuts are on the way has itself created a risk, other analysts pointed out.

“To keep the expansion going the Fed has boxed itself in to deliver more rate cuts this year,” Scott Minerd, chairman of Guggenheim Investments, wrote in a note Friday. “This may drive a rally in risk assets based on the market’s perception that liquidity will be plentiful during this period of Fed easing.”

Such a response would mirror that in the late 1990s, when the Fed pivoted from tightening to easing as a result of the Asian financial crisis – leading investors to pump up risk assets, and especially tech stocks, Minerd added.

That said, a spate of regional Fed presidents earlier this week dampened hopes for further policy easing.

Kansas City Fed President Esther George told Yahoo Finance Thursday that “cutting interest rates won’t resolve any uncertainty” surrounding trade, adding that she was monitoring U.S. economic data before committing to a next move in monetary policy.

George had been one of two dissenters from the Fed’s July decision to cut rates. The second dissenter – the Boston Fed’s Eric Rosengren – has also suggested he opposed deeper rate cuts, in an interview earlier in August with Bloomberg.

But remarks from other Fed presidents at Jackson Hole this week suggested the chorus of central bank officials considering a pause on rate cuts has mounted.

Philadelphia Fed leader Patrick Harker told CNBC Thursday that he agreed to July’s rate cut only “somewhat reluctantly,” and said he thinks “we should stay here for a while” on rates. Harker, however, is not a voting member of the Federal Open Market Committee, but he will still be part of the deliberation process during this year’s Fed meetings.

This week’s line-up of retail earnings results ended with a fizzle, with quarterly reports from The Gap (GPS) and Foot Locker (FL) falling short of expectations.

Foot Locker on Friday reported sales results that missed consensus expectations. Closely watched comparable same-store sales rose 0.8%, versus an increase 3.3% expected. Adjusted earnings were 66 cents per share on revenue of $1.77 billion, failing to meet expectations for adjusted EPS of 67 cents on sales of $1.82 billion.

“While our results in the second quarter did come in at the low end of our expectations, we saw improvement in our performance as we moved through each month of the quarter,” Foot Locker CEO Richard Johnson said in a statement. “We remain deeply connected with sneaker and youth culture, and believe this positive momentum exiting the quarter has us well positioned for the back-to-school period and beyond.”

Meanwhile, Gap reported a fourth consecutive quarter of flat to negative same-store sales Thursday after market close, highlighting the retailer’s ongoing challenge to meet consumers’ apparel demands and streamline the business.

Gap comparable same-store sales fell 4% in the quarter, worse than the 3% decline expected, and worsened across each of the Gap, Banana Republic and Old Navy brands in the company’s portfolio. Company net sales of $4.01 billion were just short of consensus expectations. Adjusted earnings of 63 cents, however, topped expectations by 10 cents.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Economy adds 164,000 jobs in July, unemployment rate sits at 3.7%

Netflix’s 2Q global paid subscriber additions miss expectations

Tech companies like Lyft want your money – not ‘your opinion’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read the latest financial and business news from Yahoo Finance

KUALA LUMPUR, Aug 22 — The ringgit closed lower against the US dollar today following tepid trading ahead of the highly-anticipated Jackson Hole symposium.

At 6pm, the ringgit finished at 4.1880/1910 against the greenback from 4.1750/1800 yesterday.

VM Markets Pte Ltd managing partner Stephen Innes said it was a very quiet day in for the ringgit as the market sits tight awaiting the Federal Reserve’s (Fed) annual Jackson Hole outcome on future US interest rate cuts and the direction the US-China trade discussions will take.

Fed chairman Jerome Powell will deliver a speech at the annual central banking symposium in Jackson Hole, Wyoming, tomorrow.

“A dovish Fed at Jackson Hole should provide a boost to the ringgit from a carry trade and risk-on sentiment.

“But for the ringgit to make significant gains below 4.15, a discernible improvement on the trade war front is needed,” he told Bernama.

The ringgit was traded lower against other major currencies.

It was traded weaker against the Singapore dollar at 3.0197/0221 from 3.0186/0226 and fell against the yen at 3.9365/9404 from 3.9202/9264 yesterday.

The ringgit also dropped vis-a-vis the British pound to 5.0813/0854 from 5.0634/0703 and versus the euro at 4.6407/6449 from 4.6317/637 previously. — Bernama

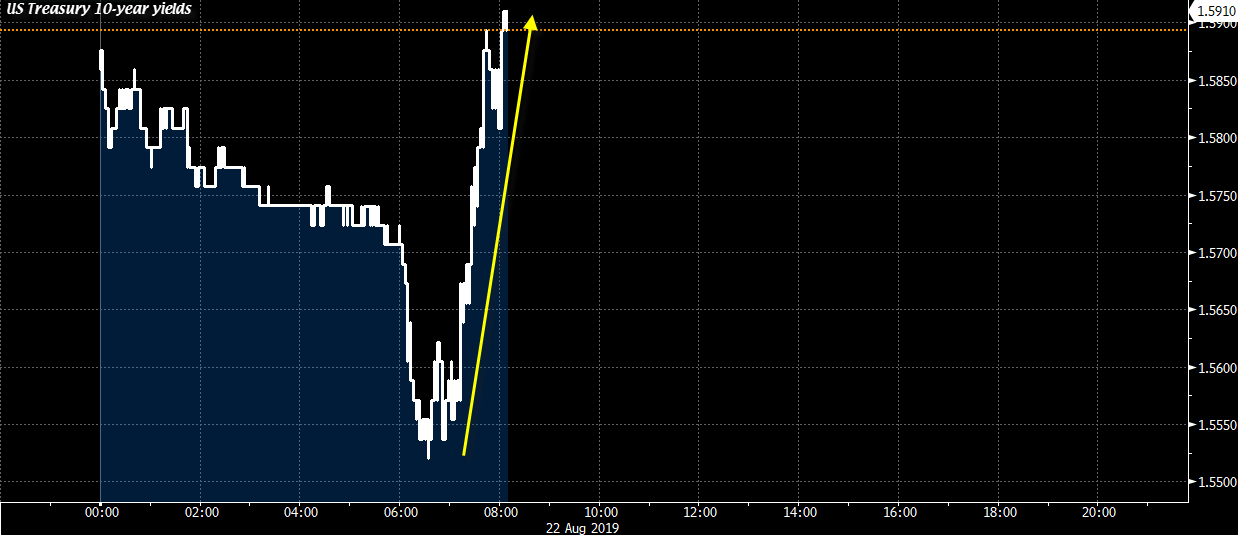

US 10-year yields are back to flat levels now as yields are higher across the curve following some optimism being fed through from the euro area PMI data beats in the past hour.

The headlines were certainly decent and showed some improvement in business growth for the month of August. However, the details painted a different picture for the most part.

In Germany, the first thing to notice is that the weakness in the manufacturing sector is starting to transfer over to the services sector. The services print may be better-than-expected but the reading was a seven-month low.

Add to the fact that the manufacturing reading continues to sit at recession-like levels and that the outlook for new orders was seen falling deeper into contraction territory, things are not well. To top things off, the expectation for future output turned negative for the first time since 2014 as well.

Moving over to overall euro area readings, the expectation for future output in all three components declined sharply. The sub-reading in question fell to its weakest level since November 2012 on the manufacturing side, weakest level since October 2014 on the services side, and weakest level since May 2013 on the composite side.

Those are details that will hardly breed confidence in the coming months.

The euro may gather some relief from the headlines but if the details are to go by, this will be nothing else but temporary. And all this does for bonds is serve up another opportunity for dip-buyers to get back into the game.

The key question now will be whether or not the events at Jackson Hole will be supportive of that. We'll have to wait and see. However, for the euro area outlook, it is clear that things aren't exactly seen recovering all too strongly just yet.