The euro and the risk mood are benefiting from the better-than-expected euro area PMI readings earlier

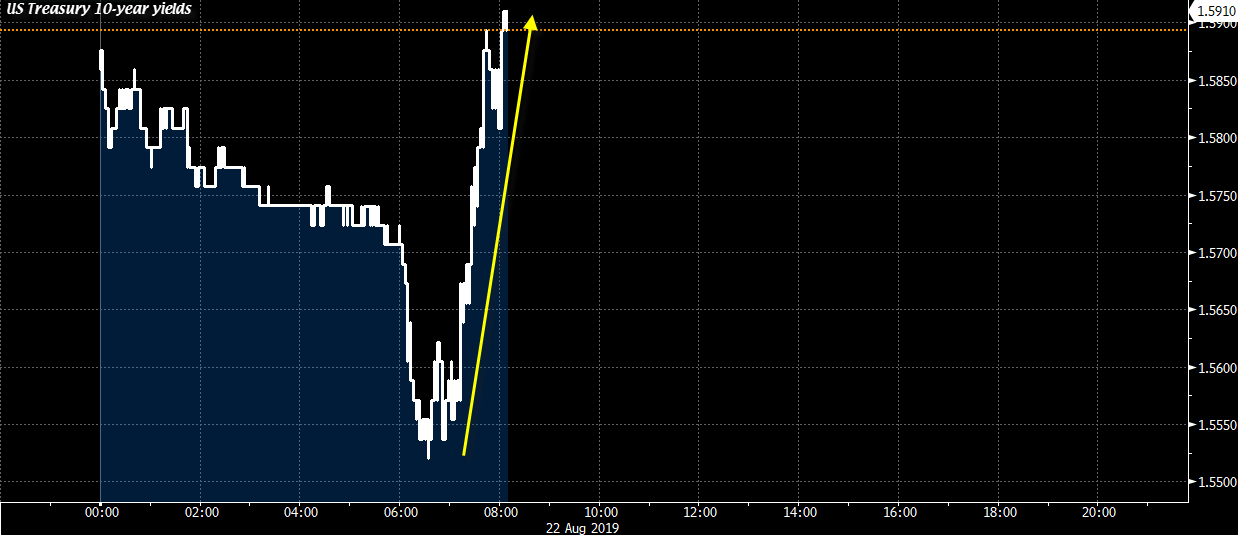

US 10-year yields are back to flat levels now as yields are higher across the curve following some optimism being fed through from the euro area PMI data beats in the past hour.

The headlines were certainly decent and showed some improvement in business growth for the month of August. However, the details painted a different picture for the most part.

In Germany, the first thing to notice is that the weakness in the manufacturing sector is starting to transfer over to the services sector. The services print may be better-than-expected but the reading was a seven-month low.

Add to the fact that the manufacturing reading continues to sit at recession-like levels and that the outlook for new orders was seen falling deeper into contraction territory, things are not well. To top things off, the expectation for future output turned negative for the first time since 2014 as well.

Moving over to overall euro area readings, the expectation for future output in all three components declined sharply. The sub-reading in question fell to its weakest level since November 2012 on the manufacturing side, weakest level since October 2014 on the services side, and weakest level since May 2013 on the composite side.

Those are details that will hardly breed confidence in the coming months.

The euro may gather some relief from the headlines but if the details are to go by, this will be nothing else but temporary. And all this does for bonds is serve up another opportunity for dip-buyers to get back into the game.

The key question now will be whether or not the events at Jackson Hole will be supportive of that. We'll have to wait and see. However, for the euro area outlook, it is clear that things aren't exactly seen recovering all too strongly just yet.

https://www.forexlive.com/news/!/markets-more-optimistic-on-euro-area-data-but-the-details-offer-a-different-take-20190822

2019-08-22 08:25:56Z

52780360724361

Tidak ada komentar:

Posting Komentar