U.S. stocks retreated Thursday morning, with those for the Dow under pressure after disappointing 3M Co. earnings, while positive tech-sector earnings reports blunted losses in the Nasdaq and S&P 500.

Against the backdrop of a parade of quarterly results, investors have been weighing continued signs of sluggish growth permeating international economies.

How did benchmarks fare?

The Dow Jones Industrial Average

DJIA, -0.59%

lost 250 points, or 0.9%, at 26,353, the S&P 500 index

SPX, +0.01%

edged 9 points, or 0.3%, lower at 2,917, while the Nasdaq Composite Index

COMP, +0.24%

fell 7 points, or 0.1%, at 8,095.

On Wednesday, the Dow fell 59.34 points, or 0.2%, to 26,597.05, while the S&P 500 index shed 6.43 points, or 0.2%, to 2,927.25. The Nasdaq Composite Index dropped 18.81 points, or 0.2%, to 8,102.01. During the session, the tech-heavy index set a new intraday high of 8,139.55.

See: Stock markets are ringing up records and bonds are rallying too

What’s drove the market?

Guidance derived from American companies about the state of economy and the business climate has helped to underpin a mostly steady advance for equity markets so far this week, but mounting signs of economic weakness everywhere from Europe to Australia have cast a shadow over markets.

Major global exporter South Korea (paywall), was one of the most recent indicators of a pullback in expansion as the Asian country’s first-quarter gross domestic product shrank by 0.3%, marking its worst performance in more than a decade. The data come a day after a reading of consumer prices in Australia remained flat in the first quarter, increasing expectations for a rate cut from the Reserve Bank of Australia.

The spate of weakness has prompted central banks, including the Reserve Bank of Australia, the Bank of Canada and the Bank of Japan to adopt more dovish policy stances, which has, in turn, pushed the U.S. dollar to roughly two-year high, which is seen as holding the potential to buffet multinational companies at some point.

Meanwhile, a parade of earnings rolled on, with 3M Co.

MMM, -11.02%

notably, driving early market action after the diversified industrial giant slashed its full-year 2019 guidance and said it would cut 2,000 jobs, with a decline in shares of the company providing the stiffest headwind for the price-weighted Dow industrials. Meanwhile, Microsoft Corp.

MSFT, +3.77%

was offsetting some of pullback after the it reported healthy quarterly results late-Wednesday and looked close to entering the $1 trillion-dollar market-cap club for the first time.

See: Microsoft’s stock crosses trillion-dollar threshold intraday for the first time

What stocks are in focus?

Facebook Inc.

FB, +6.22%

reported revenue and profit that topped Wall Street estimates, helping drive shares of the company up 6.6%. However, the social-media giant did set aside some $3 billion for a potential regulatory fine related to its handling of client data.

Shares of Microsoft were up 3.6% Thursday, after its late-Wednesday results.

3M Co., the maker of Scotch tape and Post-it Notes, saw its shares tumble 10.2%.

Shares of Xilinix, Inc.

XLNX, -16.05%

fell more than 15% early Thursday, after the chip maker beat lowered expectations for fiscal fourth quarter earnings and revenue. The stock has risen 64.1% year-to-date.

Southwest Airlines Co.

LUV, +3.56%

edge 0.2% higher, after the air carrier reported first-quarter earnings that beat expectations, although load factor fell shy and the company raised its unit costs outlook.

Read: Why tech stocks can continue to lead the S&P 500 higher, in two charts

Shares of Altria Group Inc.

MO, -5.98%

retreated 4.9% after its first-quarter report.

Comcast Corp.

CMCSA, +3.38%

fell 2.8% Thursday morning, after the media company reported first-quarter earnings that topped estimates but fell short of revenue expectations.

Hershey Co.’s stock

HSY, +5.21%

rose 5% Thursday morning, after the chocolate-and-snacks company reported first-quarter earnings that exceeded Wall Street estimates for profit and revenue.

United Parcel Service Inc.

UPS, -7.28%

saw its shares retreat 8% Thursday after the parcel company reported quarterly results that disappointed Wall Street on earnings and revenue.

Shares of defense contractor Raytheon Co.

RTN, -4.66%

fell 5.8% Thursday morning, even after better-than-expected first-quarter results. The Waltham, Mass.-based company said it had net income of $781 million, or $2.77 a share, up from $633 million, or $2.19 a share, in the year-earlier period.

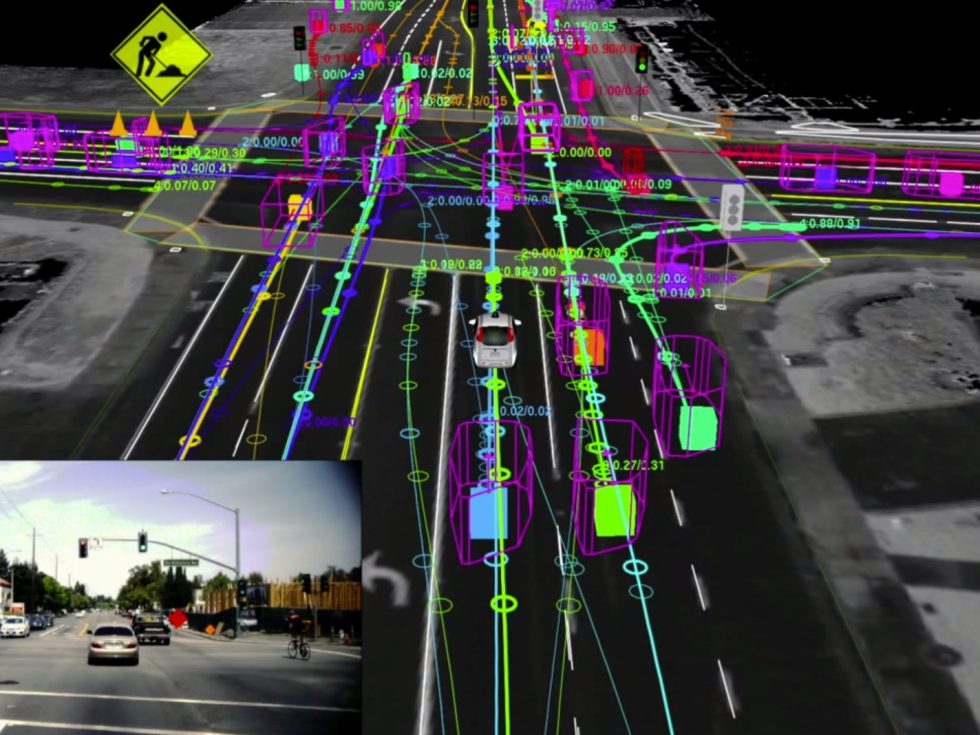

Tesla Inc.

TSLA, -3.00%

was in focus after the electric-car maker produced a wider-than-expected quarterly loss. Shares were off 1.9%.

Opinion: Elon Musk keeps moving Tesla’s finish line

Shares of Deutsche Bank AG

DBK, -1.91%

and Commerzbank AG

CBK, -2.96%

were in focus after the banking giants terminated merger talks. Shares Frankfurt-listed Deutsche Bank fell 1.3 %, while those for Commerzbank declined 2.6%.

What data are ahead?

The number of Americans who applied for first-time jobless benefits surged to 230,000 in the week ended April 20, up from 193,000 during the previous week, and above the 201,000 expected by economists polled by MarketWatch.

Orders for durable goods rose by 2.7% in March, the largest one-month increase since last summer, the Commerce Department said Thursday. Economists polled by MarketWatch had expected a 0.5% jump. When stripping out more volatile orders for aircraft and autos, orders rose 0.4%, still above the 0.3% increase forecast by economists.

A key measure of business investment, core durable orders, rose 1.3% in March, the third straight monthly increase.

National vacancy rates for rental homes remained steady at 7% in the first quarter of 2019, compared with the previous three months, while vacancy rates for homeowner housing fell 0.1%., the Commerce Department said Thursday.

The national homeownership rate of 64.2% remained steady relative to the year-ago period but fell 0.6 percentage point relative to the fourth quarter of 2018.

What are strategist saying?

“It’s been a solid week for earnings, but with expectations being so low, companies that beat earnings aren’t being rewarded as much as companies that miss forecasts are getting smacked,” J.J. Kinihan, chief market strategist at TD Ameritrade told MarketWatch.

“The world’s reserve currency advanced across the board on Wednesday, with the dollar index soaring to 2-year highs, even without any U.S.-specific catalyst. Instead, the greenback capitalized on weakness in other major currencies, most notably in the euro, Aussie, kiwi, and loonie,” wrote Marios Hadjikyriacos, investment analyst at brokerage XM.com, in a Thursday research note.

How were other markets performing?

The Shanghai Composite

SHCOMP, -2.43%

lost 2.2% and the CSI 300 Index

000300, -2.19%

gave up 2.2%, while the Stoxx Europe 600 index,

SXXP, -0.28%

was trading 0.6% lower.

Gold prices

GCM9, +0.21%

edged higher while the ICE Dollar Index

DXY, +0.06%

fell roughly 0.1%.

Providing critical information for the U.S. trading day. Subscribe to MarketWatch's free Need to Know newsletter. Sign up here.

Let's block ads! (Why?)

https://www.marketwatch.com/story/dow-futures-under-pressure-as-3m-co-says-it-will-cut-2000-jobs-nasdaq-set-to-resume-climb-2019-04-25

2019-04-25 14:43:00Z

52780276668806