Jim Cramer weighed in on Citigroup and Goldman Sachs, which both released earnings before the bell Monday morning.

Citigroup's Earnings

Real Money Stock of the Day Citigroup (C - Get Report) posted better-than-expected results for the first quarter as a steep cut in the U.S. bank's effective corporate tax rate helped to offset a fall in stock-trading revenue, wrote TheStreet's Bradley Keoun.

Net income climbed by 2% from a year earlier to $4.71 billion, the New York-based bank said Monday in a press release. Earnings per share were $1.87, beating Wall Street analysts' average estimate of $1.80.

Goldman Sachs Earnings

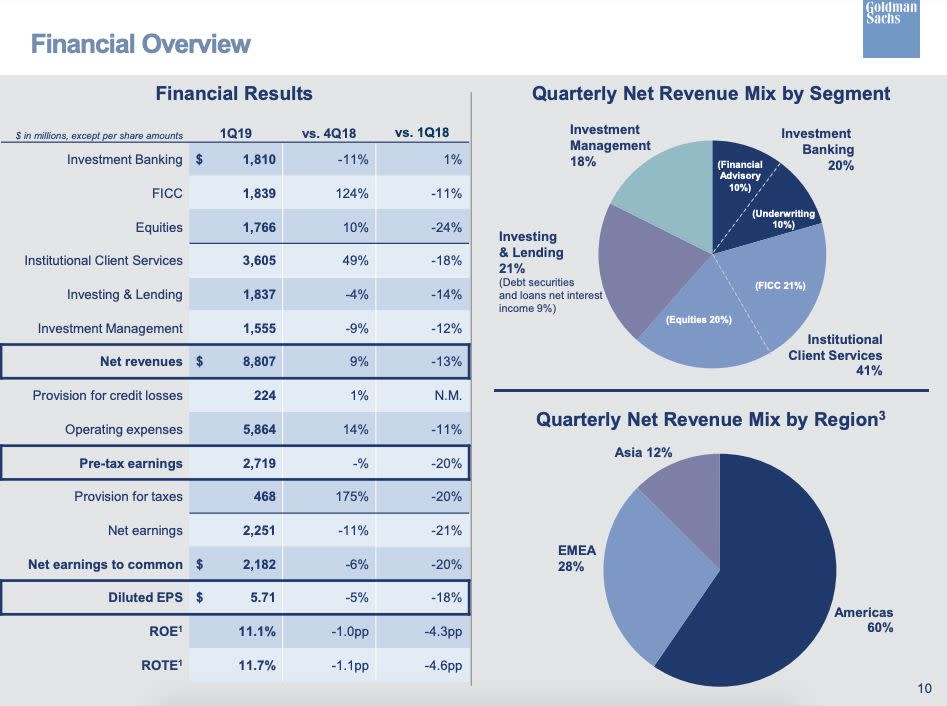

Goldman Sachs (GS - Get Report) said first-quarter profit fell less than expected, as fees from advising on mergers and acquisitions helped to mitigate an abysmal performance from the Wall Street bank's juggernaut trading business, wrote Keoun.

Net income fell by 21% from a year earlier to $2.25 billion, the New York-based bank said Monday in a press release. Earnings per share were $5.71, beating Wall Street analysts' average estimate of $4.89.

Investment-banking fees climbed 1% from a year earlier to $1.81 billion, though revenue from trading bonds, commodities and currencies declined by 11% to $1.84 billion, and stock-trading revenue tumbled 24% to $1.77 billion.

Related. Citigroup's Mixed Results Prompt Muddled Reaction in Its Shares

Watch Jim Cramer's Daily NYSE Show and Replays Below

https://www.thestreet.com/video/cramer-citigroup-goldman-sachs-earnings-14927127

2019-04-15 16:12:41Z

52780269367874