Goldman Sachs (^GS) delivered better-than-expected first quarter earnings per share but missed on revenue, amid a steep drop in trading.

For the first quarter, the bank delivered adjusted earnings per share of $5.71, versus analysts’ estimates of $4.99.

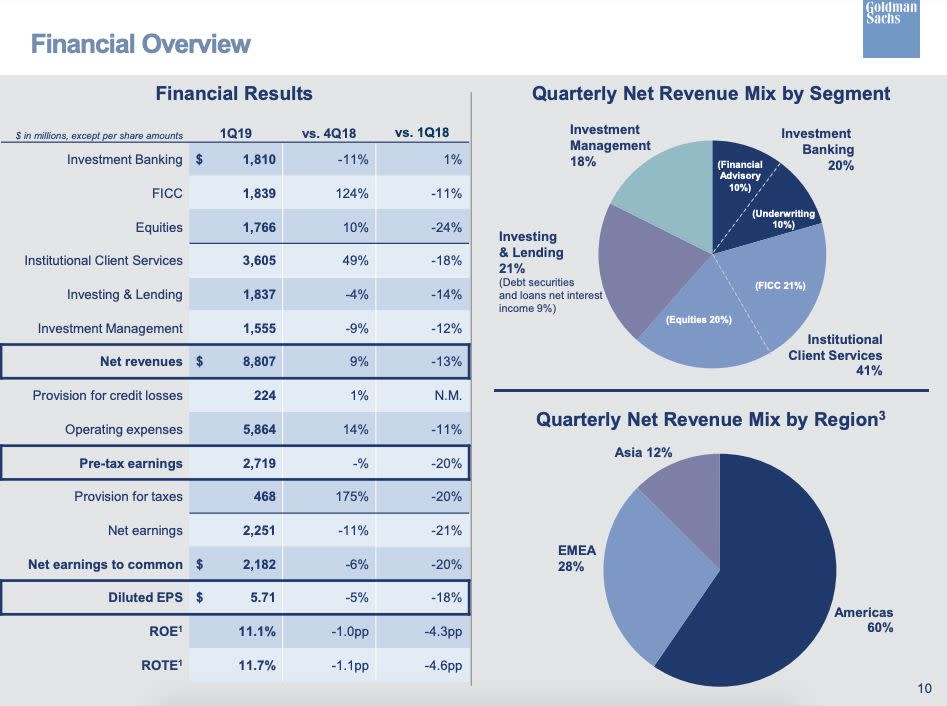

Revenue for the quarter came in at $8.81 billion, missing analysts’ forecasts of $8.97 billion. The $8.81 billion figure is 13% lower than the revenue posted during the first quarter of 2018. The drop reflected lower revenues in the institutional client services and investing and lending businesses.

In a statement, CEO David Solomon said Goldman Sachs was “focused on new opportunities to grow and diversify our business mix and serve a broader range of clients globally. With improving momentum across our businesses, we are confident that Goldman Sachs will generate attractive returns for our shareholders.”

Goldman’s results largely reflected what analysts had already anticipated would be a tough quarter for big bank trading, given the volatile market conditions.

Breaking the results down, net revenues for fixed income, currency and commodities (FICC) dropped 11% from the year prior to $1.84 billion. The slump in FICC was attributed to “lower net revenues in interest rate products, currencies and credit products.”

Elsewhere, revenue from equities trading plunged 24% from a year ago to $1.77 billion primarily because of “significantly lower” net revenues in equities client execution, especially in derivatives. What’s more, trading volumes were lower impacting fees and commissions.

“During the quarter, equities operated in an environment characterized by improved market conditions, however client activity and levels of volatility were both lower compared with the fourth quarter of 2018,” the bank stated.

Meanwhile, investment banking revenues, part of Goldman’s bread and butter, were flat at $1.81 billion from the first quarter a year ago — and 11% lower than in the fourth quarter of 2018.

Within investment banking, financial advisory revenues were 51% higher than a year ago at $887 million, driven by an increase in mergers and acquisitions. Yet underwriting revenues dropped 24% to $923 million, due to an industry-wide decline in IPOs and fewer leveraged finance transactions.

Goldman also boosted its quarterly dividend to 85 cents per share.

Shares of Goldman briefly popped in pre-market trading, but trended lower ahead of the bell.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

https://finance.yahoo.com/news/goldman-sachs-reports-q1-earnings-112756222.html

2019-04-15 12:32:00Z

52780269095290

Tidak ada komentar:

Posting Komentar