https://www.cnn.com/2019/11/21/investing/charles-schwab-td-ameritrade/index.html

2019-11-21 13:01:00Z

52780443517936

Macy's on Thursday reported its first same-store sales decline in two years, casting blame on warmer weather and weak traffic at some shopping malls.

Because of the poor results, the department store chain also slashed its full-year outlook.

Macy's stock was down more than 6% in premarket trading after plummeting more than 10% following the earnings release.

Here's what Macy's reported for its fiscal third quarter compared with what analysts were expecting, based on Refinitiv data:

CEO Jeff Gennette said the sales deceleration during the quarter was "steeper" than the company had anticipated, due, in part, to a warmer fall, weaker spending by international tourists and "weaker than anticipated performance in lower tier malls."

He said the company also experienced issues, albeit briefly, on its website during the period, "in preparation for the fourth quarter."

Looking to the full year, Macy's is now calling for same-store sales, on an owned plus licensed basis, to be down by 1% to 1.5%. Previously, it was expecting a range of flat to a 1% gain. It said it expects net sales to drop 2.5% to 2%. A prior outlook was calling for net sales to be about flat. Annual adjusted earnings per share are forecast by Macy's to fall within a range of $2.57 to $2.77, down from a prior range of $2.85 to $3.05. Analysts had been calling for $2.80.

Net income during the quarter ended Nov. 2 fell to $2 million, or a penny a share, from $62 million, or 20 cents, a year earlier. Excluding one-time items, Macy's earned 7 cents a share, better than the breakeven consensus in Refinitiv's survey of analysts.

Net sales fell to $5.17 billion from $5.40 billion a year earlier, missing expectations for $5.32 billion.

Sales online and at Macy's owned and licensed stores open for at least 12 months were down 3.5%, worse than the 1% decrease analysts had expected. That also follows seven consecutive quarters of same-store sales gains.

Earlier in the week, Kohl's delivered dismal results that led to a broader sell-off among department store retailers, including Macy's and Nordstrom. Results from big-box retailers Target and Walmart were much brighter.

The group faces increased pressure, as more brands are moving away from wholesale channels, and shopping malls, and trying to sell their merchandise directly to customers.

Some of Macy's initiatives to keep its business fresh include upgrading its mobile app and tiered loyalty program, adding stop-in shops to some Macy's locations for popular brands and getting into the clothing rental and apparel resale businesses, as younger shoppers are favoring the likes of ThredUp, Rent the Runway and Stitch Fix.

Last quarter, however, heavy markdowns used by Macy's during the spring season to clear unsold merchandise weighed terribly on profits. And inventories built up, which Gennette cited as a core "challenge."

During the third quarter, Gennette said Macy's was able to clear out some of that excess inventory, "resulting in significantly improved margin compression versus the first half of the year."

He added that the company has "confidence" in its holiday plans.

Macy's shares, as of Wednesday's market close, were down nearly 50% this year, while the S&P Retail ETF (XRT) was up about 6.5%. Macy's has a market cap of roughly $4.6 billion.

Read the full press release here.

This is a developing story. Please check back for updates.

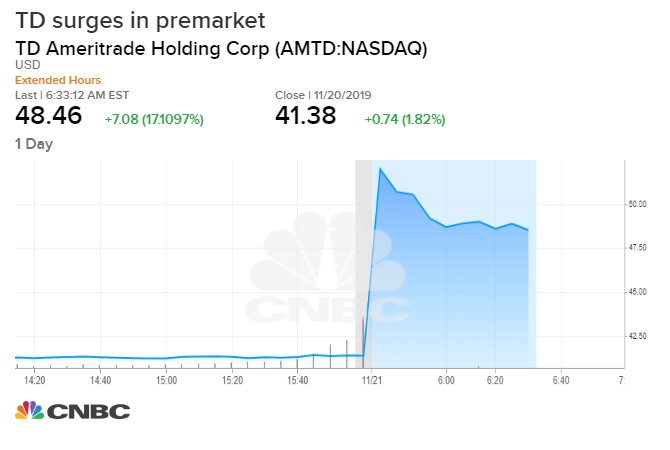

Charles Schwab is in talks to buy TD Ameritrade, a source told CNBC's Becky Quick on Thursday. A deal could be announced as early as Thursday.

Shares of TD Ameritrade soared more than 20% in premarket trading on the report. Schwab's shares rose 7%.

A deal between Schwab and TD Ameritrade would consolidate an industry going through massive disruption. In recent months, all of the major brokerages have announced plans to go to zero commissions.

Schwab was the first of the major players to make the move, eliminating commissions in early October. Schwab's competitors, including Fidelity and TD Ameritrade, were quick to follow.

Calls to Schwab and TD Ameritrade weren't immediately returned.

Schwab's founder and chairman Charles Schwab told CNBC's Bob Pisani last month that consolidation in the retail brokerage industry is a "logical conclusion that will occur."

"Certainty at the right valuation, we would do it, but we are really strong and very independent the way we do things and so if its happens that its appropriate for our shareholders we will do it," Schwab said in response to if Schwab is a possible buyer of another broker.

Not charging for trades is a boon for consumers, but it's left the brokerages scrambling to find ways to maintain profits. A deal between Schwab and TD Ameritrade would create a behemoth with $5 trillion in combined assets.

Major brokerage firms have been pressured to go to zero fees since 2013 when Silicon Valley start-up Robinhood offered stock trading for free. Since then, Vanguard Group slashed fees on exchange-traded funds trades and J.P. Morgan Chase started its own free trading app. Interactive Brokers also announced a commission-free product called IBKR Lite. Other players include ETrade Financial.

After dropping commissions, Schwab's stock was under pressure as investors worried that the lost commission revenue, which fed about $90 million to $100 million in quarterly revenue, would pressure margins. However, the stock has recovered, bolstered by strong earnings last month that showed client assets reached a record high in the third quarter. Last week, Schwab showed that the free trading is paying off in terms of new client accounts. The broker said it added 142,000 new brokerage accounts in October, 31% more than the number of new clients added in September and a 7% jump from October of last year. The new accounts brought Schwab's client assets to a record $3.85 trillion.

Schwab and TD Ameritrade are the two biggest publicly traded discount brokers. Schwab has a market capitalization of $57.5 billion, and Ameritrade has a $22.4 billion market cap,

Shares of discount brokers rose on hopes for further consolidation in the sector, with Interactive Brokers up 3.3% and E-Trade surging 6.8%.

—CNBC's Becky Quick and Terri Cullen contributed to this report.

Target's business is booming thanks to the retailer's investments to make it as easy as possible for shoppers to buy things online and get them that same day.

When Target reported quarterly earnings on Wednesday, it said digital sales surged 31%, with its same-day services accounting for 80% of that growth. Those services include a curbside pickup option, same-day delivery via its Shipt network and buy online, pick up in store.

It has been a concern among analysts and investors when retailers, including Walmart, have started selling more online, because those sales are less profitable and require heftier costs to get those orders to customers' homes. Walmart is still losing money online. But Target says it has found a way to slash costs and make money.

"When it's delivered by our stores ... those look a lot more like store economics," CEO Brian Cornell said during an interview on "Squawk Box" with CNBC's Becky Quick.

He said when Target fulfills an online order from the back of its stores versus shipping from a distribution center, "about 40% of the cost goes away." He said when customers order online and pick up at a store, use curbside pickup or select shipping via Shipt, "about 90% of the cost goes away."

"We certainly like that," he said.

Walmart has likewise been adding in-store pickup for grocery orders, which is now available at 3,100 stores.

Arguably, this is the one area where Amazon can't compete at the same size and scale. It doesn't have a network of stores, like Target and Walmart, where shoppers can pick up orders. But it has been adding Amazon lockers to its Whole Foods grocery stores and shopping malls.

Target said Wednesday its net income rose 15.5% to $706 million during the latest period ended Nov. 2, up from $616 million a year earlier.

The company also raised its full-year profit outlook, now expecting full-year adjusted earnings per share to fall within a range of $6.25 to $6.45, compared with a prior estimate of $5.90 to $6.20. Analysts had been calling for earnings per share of $6.18.

Target shares surged more than 10% in premarket trading following its report, putting the stock on pace to open at a record high.

Target earnings and sales trounced analysts' estimates, marking a bright spot in retail after weak reports from department store chains J.C. Penney and Kohl's.

The big-box retailer also raised its profit outlook for the full year, ahead of the all-important holiday shopping season.

Its shares surged more than 10% in premarket trading on the news.

CEO Brian Cornell said the results are "further proof of the durability" of Target's investment strategy, as the retailer has an "unmatched suite of easy and convenient fulfillment options."

Here's what Target reported for its fiscal third quarter compared with what analysts were expecting, based on Refinitiv data:

Target now expects full-year adjusted earnings per share to fall within a range of $6.25 to $6.45, compared with a prior estimate of $5.90 to $6.20. Analysts had been calling for earnings per share of $6.18.

Net income during the period ended Nov. 2 grew to $714 million, or $1.39 per share, compared with $622 million, or $1.17 per share, a year ago. Excluding one-time items, Target earned $1.36 per share, beating expectations for $1.19 a share, based on an analyst survey by Refinitiv.

Total revenue grew 4.7% during the quarter to $18.67 billion from $17.82 billion a year earlier, beating expectations for $18.49 billion.

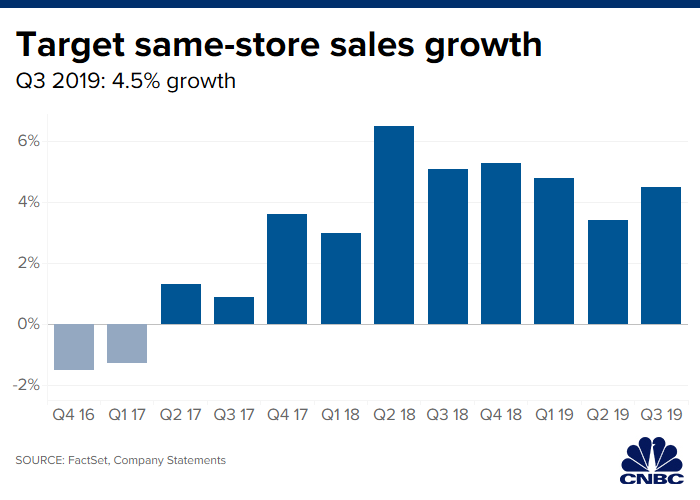

Sales at Target stores open for at least 12 months and online were up 4.5%, better than expected growth of 3.6%.

The company said digital sales surged 31% during the quarter, with its same-day delivery options including buy online, pick up in store and curbside pickup accounting for 80% of digital sales growth.

Target said traffic during the third quarter was up 3.1%. The average transaction amount grew 1.4%.

For the fourth quarter, Target said it expects same-store sales to be up 3% to 4%.

Many analysts have been expecting Target to head into the holiday season with the wind at its back. The company has made investments to refresh its stores, open small-format locations in urban markets like New York and around college campuses, launch in-house brands — including a new grocery line — and add faster delivery options thanks to its Shipt platform for same-day shipments.

Cornell told CNBC's Becky Quick that when Target fulfills an online order from the back of its stores versus shipping from a distribution center, "about 40% of the cost goes away." He said when customers order online and pick up at a store, use curbside pickup or select shipping via Shipt, "about 90% of the cost goes away."

"When it's delivered by our stores ... those look a lot more like store economics," the CEO explained.

Meanwhile, Target has a partnership with Disney to open mini Disney shops in some Target stores. It also has teamed with the parent company of the Toys R Us brand, TRU Kids, to help relaunch and now run ToysRUs.com.

Target said in October it expected to spend $50 million more on payroll during the fourth quarter than it did a year earlier, in order to offer more overtime and increase the number of workers in stores at the busiest hours this holiday season. 2018 was Target's "most successful holiday in more than a decade," according to Cornell.

Big-box rival Walmart last week reported better-than-expected earnings and raised its profit outlook for the full year, building on the strength of its grocery business.

Target's stock has rallied more than 67% this year. The company has a market cap of $56.5 billion, compared with Walmart's $341 billion.

Lowe's on Wednesday reported quarterly earnings that beat analysts' expectations and raised its forecast for the year, but revenue fell short of projections.

The home improvement retailer also announced that it has restructured its Canadian leadership and plans to close 34 stores in Canada in the fourth quarter.

Shares of Lowe's were up more than 4% in premarket trading.

Here's what Lowe's reported compared with what Wall Street was expecting, based on a survey of analysts by Refinitiv:

Lowe's now expects to earn $5.63 to $5.70 per share in fiscal 2019, on an adjusted basis, compared with a prior estimate of $5.67 per share.

In the third quarter ended Nov. 1, Lowe's said net income grew to $1.05 billion, or $1.36 per share, from $629 million, or 78 cents per share, a year earlier. Excluding items, the company earned $1.41 per share, topping estimates of $1.35 per share in the Refinitiv survey.

Sales grew $17.39 billion, just shy of analyst estimates of $17.68 billion.

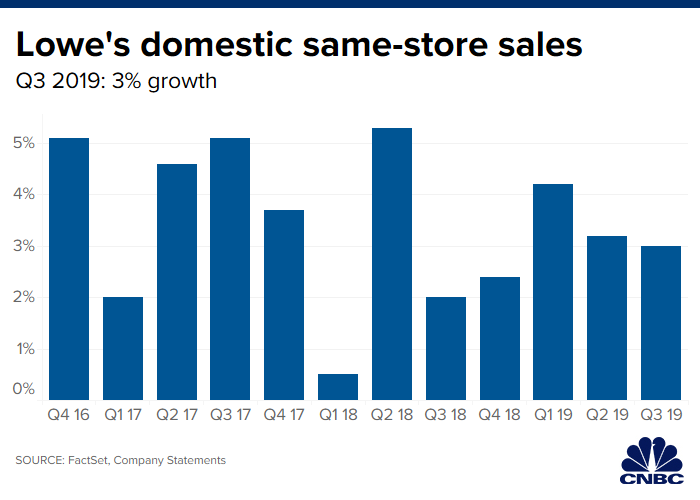

Consolidated same-store sales grew 2.2%. Analysts were expecting a 3.1% gain. Sales at U.S. stores open at least 12 months rose 3%.

"We were pleased with the performance of our U.S. home improvement stores, which reflects a solid macroeconomic backdrop and continued progress in our transformation driven by investments in customer experience, improved merchandise category performance, and continued growth of our Pro business," CEO Marvin Ellison said in the earnings release.

Despite the store closures in Canada, Ellison said the company is "committed" to its Canadian operations.

"While making decisions that impact our associates and their families is never easy, closing underperforming stores is a necessary step in our plan to ensure the long-term stability and growth of our Canadian business," said Tony Cioffi, interim president of Lowe's Canada.

Since Ellison arrived in July 2018, he has focused on sales to professional contractors. In the second quarter, Lowe's credited its ability to grow U.S. same-store sales at a faster pace than its competitor Home Depot to the effort. Lowe's said it added 35,000 new pro customers in the second quarter.

Home Depot, however, has always had its stronghold in the professional space. About 45% of Home Depot's business comes from its professional customers, according to Jonathan Matuszewski, an analyst at Jefferies. By comparison, Lowe's gets about 20% to 25% of its sales from this group, he said.

Home Depot on Tuesday reported weaker-than-expected fiscal third-quarter sales, and cut its 2019 sales forecast, because its latest investments are taking more time than expected to pay off.

The Atlanta-based company said Tuesday it is in the process of improving its B2B website, which was created mostly for the company's pro customers. The site still requires underlying technical work before the company can move forward with additional elements.

Here are five things you must know for Wednesday, Nov. 20:

U.S. stock futures fell Wednesday after China condemned a U.S. Senate resolution supporting human rights in Hong Kong and Donald Trump again threatened to increase tariffs if Washington and Beijing aren't able to negotiate a near-term trade agreement.

China's displeasure with the Senate resolution, known as the "Hong Kong Human Rights and Democracy Act," comes at a sensitive juncture in the trade negotiations following reports from China-backed media that Beijing won't accept an agreement that doesn't include the cancellation of tariffs from Washington.

Chinese Foreign Ministry spokesman Geng Shuang said the Senate move was designed to "bolster anti-China, extremist and violent radicals who attempt to disrupt Hong Kong," and cautioned that "all those attempts to interfere in or impede China's development will be in vain."

Trump, meanwhile, told a cabinet meeting Tuesday that "if we don't make a deal with China, I'll just raise the tariffs even higher." The president added China would need to offer a deal "I like" in order to complete the first phase of the the negotiations.

Contracts tied to the Dow Jones Industrial Average fell 111 points, futures for the S&P 500 were down 12 points, and Nasdaq futures tumbled 43 points.

The Nasdaq closed at another record high Tuesday, the only one of the three major stock indexes to finish in positive territory, as disappointing sales forecasts from Home Depot (HD - Get Report) and Kohl's (KSS - Get Report) , along with ongoing concerns about a U.S.-China trade agreement, pulled shares lower.

The Nasdaq rose 20.72 points, or 0.24%, to close at 8,570.66. The Dow sank 102.20 points, or 0.36%, to 27,934.02, while the S&P 500 slipped 1.85 points, or 0.06%, to 3,120.18.

Target's (TGT - Get Report) third-quarter earnings came in better than expected and the retailer raised its full-year profit guidance, sending shares up 10% in premarket trading to $121.90.

Lowe's (LOW - Get Report) posted stronger-than-expected third-quarter earnings and lifted its full-year profit guidance, offering a stark contrast to its larger home- improvement rival Home Depot (HD - Get Report) which but trimmed its full-year sales guidance on Tuesday. Lowe's rose 4.45% to $118.45.

The economic calendar in the U.S. Wednesday includes Oil Inventories for the week ended Nov. 15 at 10:30 a.m. ET, and minutes from the Federal Reserve's Oct. 30 meeting at 2 p.m.

Donald Trump is scheduled Wednesday to tour an Apple (AAPL - Get Report) manufacturing plant in Austin, Texas, where Mac Pro computers are made.

Apple CEO Tim Cook has established a strong relationship with the president as the tech giant faces U.S. tariffs on imports from China.

The Trump administration is currently considering whether to exempt Apple goods from a 15% tariff that took effect Sept. 1, covering about $110 billion in Chinese imports including the Apple Watch, AirPods and parts for the iPhone, according to Bloomberg.

Trump will visit the Austin factory where Apple contractor Flex Ltd. assembles some of the company's laptops. Treasury Secretary Steven Mnuchin and White House economic adviser Larry Kudlow are expected to accompany Trump.

"We're building the Mac Pro - Apple's most powerful computer ever - right here in Austin because we believe in the power of American innovation," Cook said in a statement released by the White House.

Apple is a holding in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells AAPL? Learn more now.

E-commerce giant Alibaba (BABA - Get Report) said its roughly $11.3 billion offering on the Hong Kong Stock Exchange for institutional investors will be priced at HK$176 a share ($22.48), or about $HK88 billion.

An over-allotment clause in the sale of the 500 million shares could bring the total to $12.9 billion, just shy of the $13.4 billion first expected when it launched the offering earlier this month. The offering is likely to be the biggest of 2019.

"The company plans to use the proceeds from the Global Offering for the implementation of its strategies to drive user growth and engagement, empower businesses to facilitate digital transformation, and continue to innovate and invest for the long term," Alibaba said in a statement.

American depositary receipts of Alibaba traded in the U.S. fell 1.66% in premarket trading to $182.18.

Boeing (BA - Get Report) received a firm order for 30 787 Dreamliners from Emirates, the Middle East's biggest carrier, in a deal valued at $8.8 billion.

The order replaces an agreement for 150 777x jets to 126 of that aircraft, and adds 30 of the 787-9 Dreamliners, said Emirates CEO and Chairman Sheikh Ahmed bin Saeed Al Maktoum, who spoke to reporters at the Dubai Airshow, the Associated Press reported.

Emirates on Monday announced it would be buying 20 additional wide-body Airbus A350s, bringing its total order for the aircraft to 50 in an agreement worth $16 billion at list price. The order replaces one that Emirates announced in February for 30 Airbus A350s and 40 A330Neos.