Target earnings and sales trounced analysts' estimates, marking a bright spot in retail after weak reports from department store chains J.C. Penney and Kohl's.

The big-box retailer also raised its profit outlook for the full year, ahead of the all-important holiday shopping season.

Its shares surged more than 10% in premarket trading on the news.

CEO Brian Cornell said the results are "further proof of the durability" of Target's investment strategy, as the retailer has an "unmatched suite of easy and convenient fulfillment options."

Here's what Target reported for its fiscal third quarter compared with what analysts were expecting, based on Refinitiv data:

- Earnings per share: $1.36, adjusted, vs. $1.19 expected

- Revenue: $18.67 billion vs. $18.49 billion expected

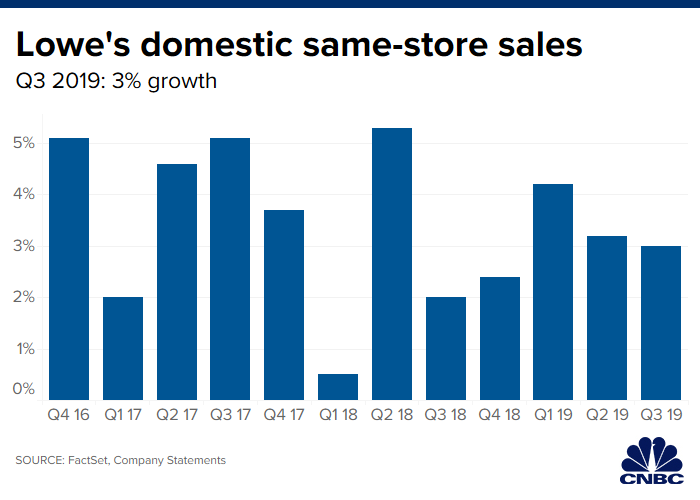

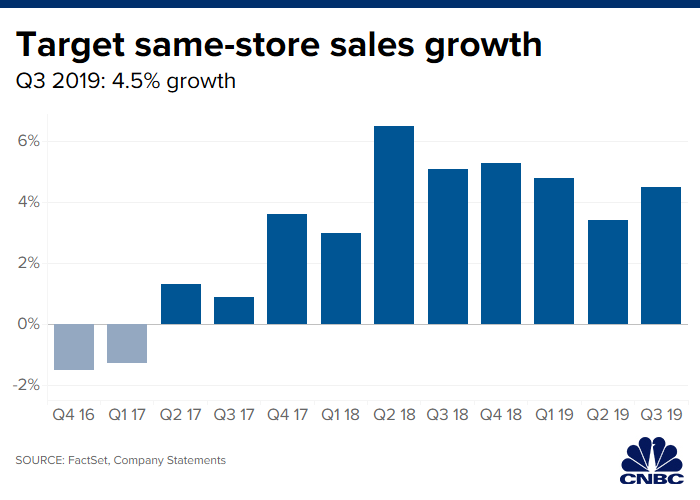

- Same-store sales: growth of 4.5% vs. up 3.6% expected

Target now expects full-year adjusted earnings per share to fall within a range of $6.25 to $6.45, compared with a prior estimate of $5.90 to $6.20. Analysts had been calling for earnings per share of $6.18.

Net income during the period ended Nov. 2 grew to $714 million, or $1.39 per share, compared with $622 million, or $1.17 per share, a year ago. Excluding one-time items, Target earned $1.36 per share, beating expectations for $1.19 a share, based on an analyst survey by Refinitiv.

Total revenue grew 4.7% during the quarter to $18.67 billion from $17.82 billion a year earlier, beating expectations for $18.49 billion.

Sales at Target stores open for at least 12 months and online were up 4.5%, better than expected growth of 3.6%.

The company said digital sales surged 31% during the quarter, with its same-day delivery options including buy online, pick up in store and curbside pickup accounting for 80% of digital sales growth.

Target said traffic during the third quarter was up 3.1%. The average transaction amount grew 1.4%.

For the fourth quarter, Target said it expects same-store sales to be up 3% to 4%.

Many analysts have been expecting Target to head into the holiday season with the wind at its back. The company has made investments to refresh its stores, open small-format locations in urban markets like New York and around college campuses, launch in-house brands — including a new grocery line — and add faster delivery options thanks to its Shipt platform for same-day shipments.

Cornell told CNBC's Becky Quick that when Target fulfills an online order from the back of its stores versus shipping from a distribution center, "about 40% of the cost goes away." He said when customers order online and pick up at a store, use curbside pickup or select shipping via Shipt, "about 90% of the cost goes away."

"When it's delivered by our stores ... those look a lot more like store economics," the CEO explained.

Meanwhile, Target has a partnership with Disney to open mini Disney shops in some Target stores. It also has teamed with the parent company of the Toys R Us brand, TRU Kids, to help relaunch and now run ToysRUs.com.

Target said in October it expected to spend $50 million more on payroll during the fourth quarter than it did a year earlier, in order to offer more overtime and increase the number of workers in stores at the busiest hours this holiday season. 2018 was Target's "most successful holiday in more than a decade," according to Cornell.

Big-box rival Walmart last week reported better-than-expected earnings and raised its profit outlook for the full year, building on the strength of its grocery business.

Target's stock has rallied more than 67% this year. The company has a market cap of $56.5 billion, compared with Walmart's $341 billion.

https://www.cnbc.com/2019/11/20/target-tgt-earnings-q3-2019.html

2019-11-20 11:19:00Z

52780441874510