United States Veterans Affairs Secretary Robert Wilkie discusses how it's important to honor veterans every day, not just on Veterans Day, and one way we can do that is by supporting them.

More than 4,000 psychologists and other medical professionals postponed their strike against health care provider Kaiser Permanente indefinitely following the death of CEO Bernard Tyson on Sunday.

Continue Reading Below

The National Union of Healthcare Workers was set to strike from Monday to Friday to demand Kaiser Permanente improve retirement and health benefits as well as look at clinicians' proposals to improve mental health care access.

"We offer our condolences to Bernard's family, friends and colleagues," NUHW President Sal Rosselli said in a statement. "Our members dedicate their lives to helping people through tragedy and trauma, and they understood that a strike would not be appropriate during this period of mourning and reflection."

One hundred seventy union leaders voted Sunday afternoon to postpone the strike, which would have shuttered mental health services at roughly 100 Kaiser Permanente clinics and medical facilities across California.

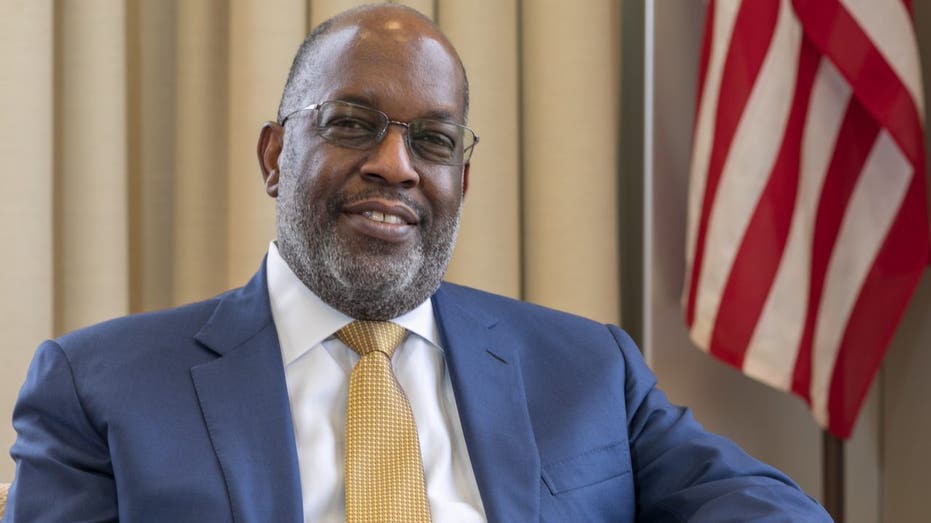

Bernard Tyson was CEO of Kaiser Permanente from 2013 to 2019. Photo courtesy of Kaiser Permanente

KAISER PERMANENTE CEO BERNARD TYSON DEAD AT 60

Tyson died in his sleep early Sunday morning. He was 60.

"I've known Bernard since he was a manager at Kaiser Oakland Medical Center in the early 1980s," Rosselli said. "While we had our differences, I had tremendous respect for him and his willingness to collaborate with workers to make Kaiser the model provider of medical services in California. We weren't able to achieve that same level of collaboration when it comes to Kaiser's mental health services, but I believed that he did want Kaiser to achieve real parity for mental health care, and I know our members remain fully committed to realizing that goal."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Kaiser Permanente maintains that a strike will not help the two sides "achieve a mutually beneficial contract." NUHW therapists receive an excellent wage and benefit package as well as plenty of time to do paperwork and make calls, Kaiser Permanente vice president of communications John Nelson told The Sacramento Bee.

Kaiser Permanente has "taken important steps to help address the nation’s crisis in mental health care – hiring hundreds of new therapists, building new treatment facilities, and investing $40 million to help people enter the mental health care profession. A strike does nothing to advance our important work to advance care, nor does it help us achieve a mutually beneficial contract," Nelson said.

FOX Business' inquiry to Kaiser Permanente was not returned immediately.

CLICK HERE TO READ MORE ON FOX BUSINESS

https://www.foxbusiness.com/money/bernard-tyson-kaiser-permanente-strike

2019-11-11 11:34:21Z

52780432343539