Tesla has reportedly secured a battery supply deal with CATL, China’s biggest battery manufacturer, to supply cells for Gigafactory 3 in Shanghai and potentially expand to other production facilities.

As of now, Panasonic is the only approved battery cell supplier for Tesla’s vehicles, but things are changing fast.

Since Tesla’s inception, Panasonic has always been the automaker’s sole battery suppliers for vehicles with the very small exception of a short-lived Tesla Roadster 3.0 battery replacement program.

Panasonic made cells in Japan and exported them to California for Tesla’s Model S and Model X programs, while the two companies partnered to make the cells for Model 3 at Gigfactory 1 in Nevada.

Over the last few years, Tesla started using battery cells from Samsung SDI and LG Chem for its stationary energy storage products, but Panasonic always had the exclusive contract to supply the automaker with battery cells for its electric vehicles.

Now it’s apparently about to change.

Earlier this year, we heard that Tesla made a battery supply deal with LG Chem for the Model 3 produced at Gigafactory 3 and now it looks like they will split the capacity with CATL.

We have been hearing since March that Tesla was in talks with CATL, but Bloomberg is now reporting that the two companies have “reached a preliminary agreement.”

Bloomberg reports that the official agreement is not certain yet and it is not expected to go through until “mid-2020”:

“Following months of negotiations, the companies clinched a non-binding deal after Tesla Chief Executive Officer Elon Musk traveled to Shanghai in late August and met with CATL Chairman Zeng Yuqun for about 40 minutes, according to the people, who asked not to be named discussing private deliberations. Though a final agreement is expected to be signed by mid 2020, there is no guarantee that will happen, the people said.”

The ‘preliminary agreement’ is for battery cells to be installed in Model 3 vehicles to be built at Gigafactory 3 in Shanghai, but they are reportedly also “separate discussions underway on a potential global supply contract.”

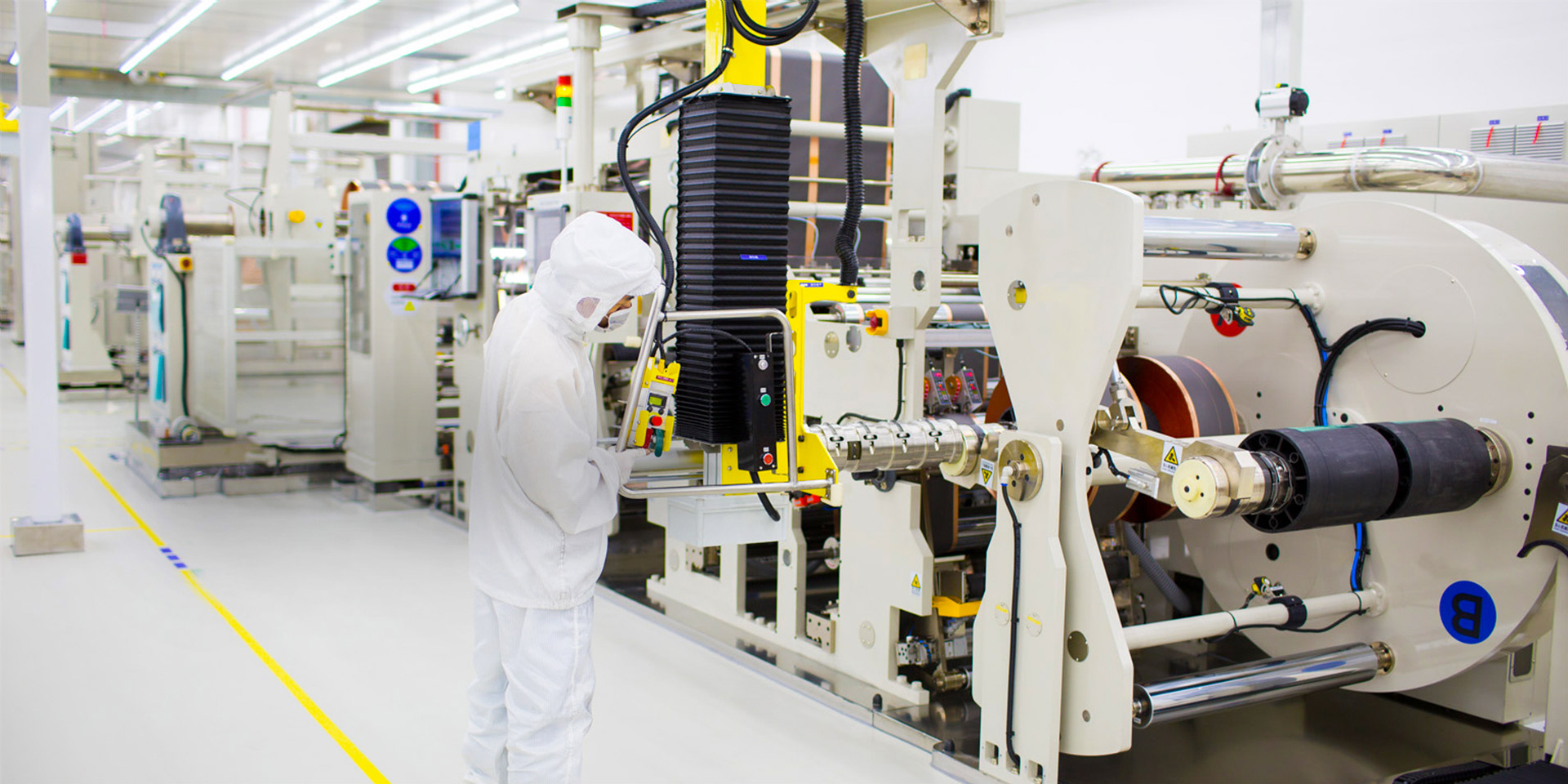

CATL has been expanding its reach lately and announced several new battery factories to support major automakers.

The Chinese company signed a supply contract with SAAB successor National Electric Vehicle Sweden (NEVS) in order to enable the production of hundreds of thousands of all-electric cars per year.

They have also secured a battery supply agreement with Honda for about 1 million electric vehicles.

CATL reportedly has a current annual production of 17.5 GWh and they are planning a new factory with a capacity of 24 GWh to come online as soon as next year.

Electrek’s Take

It’s interesting that in the space of a few months to a year, Tesla could go from a single battery cell supplier for its cars to having 3 and even likely making its own cells.

I still think that Tesla is planning to move into the battery cell manufacturing space in a big way next year, but it makes sense for the company to still build a solid supply chain with other suppliers.

Tesla is going to need an incredible amount of battery cells over the next few years and while I think that long term most of those cells are going to be built internally, I think they will still be buying billions of dollars worth of battery cells in the next few years.

FTC: We use income earning auto affiliate links. More.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

https://electrek.co/2019/11/06/tesla-secures-battery-supply-deal-catl-report/

2019-11-06 10:01:00Z

CAIiECEtevUK2tpGZI-SsyYYPccqGQgEKhAIACoHCAowqoP5CjDpz-ACMJ_YtAU