Twitter shares tanked as much as 20% Thursday after the company reported advertising and revenue "headwinds" and missed Wall Street expectations on the top and bottom lines for its third-quarter.

Here's what the company reported, compared with what Wall Street analysts were expecting, according to Refinitiv consensus estimates:

- Earnings per share: 17 cents, vs. 20 cents expected

- Revenue: $823.7 million, vs $874.0 million expected

- Monetizable daily active users: 145 million

The company cited "a number of headwinds" in its revenue shortfall, including product issues and lower-than-expected advertising volumes in July and August.

"In Q3 we discovered, and took steps to remediate, bugs that primarily affected our legacy Mobile Application Promotion (MAP) product, impacting our ability to target ads and share data with measurement and ad partners," the company said in its shareholder letter. "We also discovered that certain personalization and data settings were not operating as expected. We believe that, in aggregate, these issues reduced year-over-year revenue growth by 3 or more points in Q3."

Twitter guided toward lighter fourth-quarter revenues than Wall Street was looking for. The company expects to bring in revenue between $940 million and $1.01 billion — just shy of the $1.06 billion that analysts surveyed by Refinitiv had forecast.

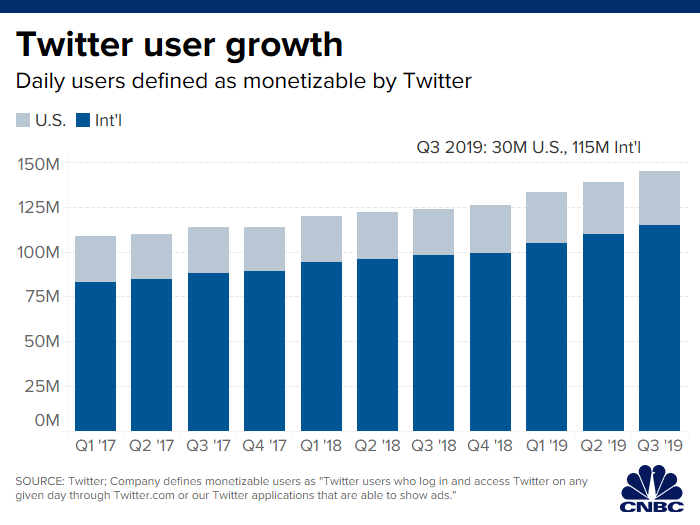

Last quarter, Twitter did away with reporting monthly active users and shifted to a new growth metric — monetizable daily active users — to measure the daily active users who are shown ads on the platform.

The 145 million mDAUs that Twitter reported for the third quarter is a 4% increase from the second quarter of 2019, when the company reported 139 million mDAUs, and a 17% increase year over year.

The "monetizable" distinction is why, Twitter says, its mDAUs fall short of the total DAUs of social media rivals like Snap and Facebook, which boast 203 million and 1.59 billion daily active users, respectively.

"Despite its challenges, this quarter validates our strategy of investing to drive long-term growth. More work remains to deliver improved revenue products. We'll continue to prioritize our ad products along with health and our investments to drive ongoing growth in mDAU," said Ned Segal, Twitter's CFO.

Twitter's quarterly expenses grew 17% during the third period, to $780 million, in part due to hiring and investment in sales, marketing, research and development. The company ended the quarter with 4,600 employees, 300 employees more than at the end of the second quarter.

The company expects to keep spending. For the fiscal year of 2019, Twitter is predicting capital expenditures to come in between $550 million and $600 million, representing a large hike from total 2018 expenditures of $487 million.

Advertising revenue for the quarter came in at $702 million, 8% higher than the same quarter during 2018. Total ad engagements increased 23% year over year, and cost per engagement dropped 12%.

Prior to the report, Twitter shares were up 35% so far in 2019, with a market cap just above $30 billion. Thursday's pre-market stock move would shave $6 billion off the company's market cap, if the losses hold into regular trading.

This story is developing. Please check back for updates.

WATCH: The rise of deepfakes and what Facebook, Twitter and Google are doing to detect them

Correction: This story has been updated to correct the quarter during which Twitter reported 139 million monetizable daily active users. That report came during the second quarter of 2019.

https://www.cnbc.com/2019/10/24/twitter-twtr-earnings-q3-2019.html

2019-10-24 10:34:49Z

52780418122769