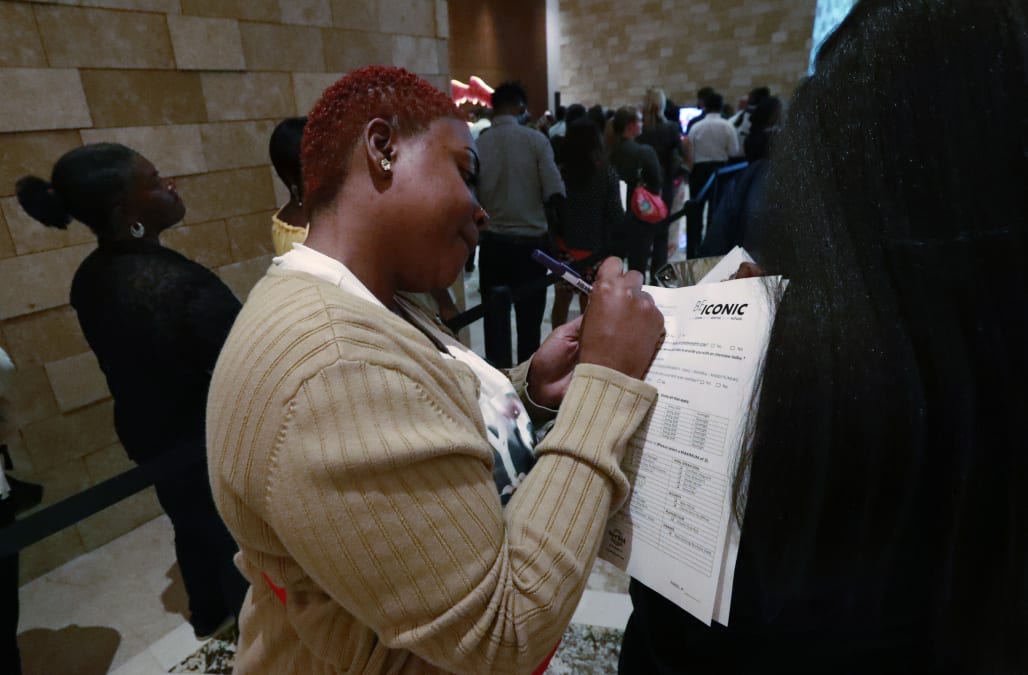

The U.S. economy added slightly fewer jobs than expected in July, while the unemployment rate held a hair above a 50-year low.

Here were the main figures from the Bureau of Labor Statistics’s July employment report, versus consensus expectations based on Bloomberg-compiled data:

Change in non-farm payrolls: +164,000 vs. +165,000 exp. and +193,000 in June

Unemployment rate: 3.7% vs. 3.6% exp. and 3.7% in June

Average hourly earnings MoM: 0.3% vs. 0.2% exp. and 0.3% in June

Average hourly earnings YoY: 3.2 vs. 3.1% exp. and 3.1% in June

Labor force participation rate: 63% vs. 62.9% expected and 62.9% in June

Friday’s “official” BLS jobs report comes as other releases on the domestic labor market have signaled ongoing strength in this area in the economy.

RELATED: 25 best jobs of 2019, according to U.S. News

25 PHOTOS

25 best jobs of 2019, according to U.S. News

See Gallery

25. Financial Manager

Industry: Business

Median Salary: $125,080

Unemployment Rate: 2.2 percent

Maximizing profits, reducing costs and producing financial reports are the key duties of financial managers. They play increasingly important roles in companies as the economy grows and interest in managing monetary risk rises. Their job titles may include controller, treasurer, finance officer, risk manager or cash manager.

Becoming a financial manager requires at least a bachelor's degree, and many employers seek candidates with master's degrees, too. Employment is expected to increase 18.7 percent by 2026, adding 108,600 jobs.

Learn more about financial managers.

24. Accountant

Industry: Business

Median Salary: $69,350

Unemployment Rate: 2.3 percent

For companies, governments or clients, accountants prepare and evaluate financial records for accuracy and to make sure taxes are promptly paid. Their responsibilities may entail making presentations or writing reports. These professionals may work as public accountants, who produce reports required by law, or management accountants, who work with internal budgets.

Accountants need at least a bachelor's degree, and many have roles that require them to earn certified public accountant licenses. Demand for accountants is predicted to increase 10 percent by 2026, adding 139,900 jobs.

Learn more about accountants.

23. Speech-Language Pathologist

Industry: Health care

Median Salary: $76,610

Unemployment Rate: 0.8 percent

Also called speech therapists, these health care workers help prevent and treat disorders related to talking and swallowing, which may be caused by stroke, hearing loss, developmental problems or Parkinson's disease. They perform their jobs in schools, doctor's offices, hospitals and nursing homes.

Speech-language pathologists need master's degrees and sometimes licenses to work. Demand is expected to increase 17.8 percent by 2026, adding 25,900 jobs.

Learn more about speech-language pathologists.

22. Podiatrist

Industry: Health care

Median Salary: $127,740

Unemployment Rate: 1.2 percent

People with calluses, arthritis, arch problems, diabetes and other ailments that affect their feet and ankles seek treatment from podiatrists. These lower-extremity experts may perform surgery, prescribe shoe inserts and give advice about how to keep feet healthy.

These professionals need to earn a four-year Doctor of Podiatric Medicine degree from one of nine accredited institutions. Then, they complete three years of residency. Demand is expected to increase 10.3 percent by 2026, adding 1,100 jobs.

Learn more about podiatrists.

21. Clinical Laboratory Technician

Industry: Health care support

Median Salary: $51,770

Unemployment Rate: 0.7 percent

After doctors and nurses order medical tests, patients head to clinical laboratory technicians, who perform the requested services. These health care support workers then analyze body fluids and tissue samples to look for possible abnormalities. They may specialize in studying blood, cells or microbes.

This is one of the few jobs on this list that requires only an associate degree or postsecondary certificate. Demand is predicted to increase 14 percent by 2026, adding 22,900 jobs.

Learn more about clinical laboratory technicians.

20. Physical Therapist

Industry: Health care

Median Salary: $86,850

Unemployment Rate: 1.2 percent

The victories physical therapists help achieve can be grand, like treating an injured Olympic athlete who goes on to win gold, or modest, like helping a patient regain the ability to tie his shoes.

These health care workers seek to decrease people's physical pain, improve their mobility and regain strength. During the rehabilitation process, physical therapists assess patient needs and teach patients to perform stretches and exercises that will ameliorate their conditions.

After finishing college, these professionals must earn Doctor of Physical Therapy degrees, which typically require three years. Demand for the job is predicted to increase by 28 percent by 2026, adding 67,100 jobs.

Learn more about physical therapists.

19. Registered Nurse

Industry: Health care

Median Salary: $70,000

Unemployment Rate: 1.4 percent

In medical settings, nurses are the health care professionals who work most closely with patients. They communicate with people about their needs and concerns, administer tests and monitor vital signs, keep records and pass information to doctors. And they teach patients and their families how to continue proper medical care at home.

Nurses can specialize in areas such as cancer, substance addiction, heart disease and birth and delivery. Some work in public health, offering screenings for diseases or vaccines for the flu.

Registered nurses typically have either bachelor’s or associate degrees in the field, plus licenses. Demand for registered nurses is expected to increase 14.8 percent by 2026, adding 438,100 jobs.

Learn more about registered nurses.

Learn more about nursing programs.

18. Cartographer

Industry: Engineering

Median Salary: $63,990

Unemployment Rate: 0.7 percent

As modern mapmakers, cartographers use surveys and images to collect and study geographic data, then turn it into useful visual representations. They're employed by the government and firms that specialize in architecture, engineering and science.

Cartographers typically have bachelor's degrees in cartography, geography, surveying or geomatics. Demand is expected to rise 19.4 percent by 2026, adding 2,400 jobs.

Learn more about cartographers.

17. Mathematician

Industry: Business

Median Salary: $103,010

Unemployment Rate: 0.9 percent

Many mathematicians analyze data and use statistical theories to help make decisions for businesses and government offices. Others work in academic settings, teaching and conducting research about how the universe works.

There are lots of job titles in this field, including programmer, systems or quantitative analyst or data scientist. The career usually requires a master’s or doctoral degree. Demand for mathematicians is expected to grow 29.7 percent by 2026, adding 900 jobs.

Learn more about mathematicians.

16. Nurse Midwife

Industry: Health care

Median Salary: $100,590

Unemployment Rate: 1.2 percent

Nurse midwives care for women and babies and advise on all aspects of reproductive health. In addition to delivering newborns, they perform gynecological exams. They may work irregular hours if they're on call to aid with deliveries.

These advanced practice registered nurses need master's degrees. Demand for their services is expected to increase 20.7 percent by 2026, adding 1,300 jobs.

Learn more about nurse midwives.

14. Surgeon (tie)

Industry: Health care

Median Salary: >$208,000

Unemployment Rate: 0.5 percent

Pay is high for this job – but so is stress. Surgeons work under extremely high pressure, spending days and nights hovering over the operating table while treating diseases and illnesses through surgery. They need steady hands, sharp reflexes and solid problem-solving skills.

These doctors may specialize in orthopedics, neurology, cardiovascular health or even plastic surgery, providing cosmetic or reconstructive services to patients. Surgeons must earn undergraduate and medical school degrees, then complete years of residency training. Demand for these doctors is expected to increase 14.4 percent by 2026, adding 6,500 jobs.

Learn more about surgeons.

Learn more about medical schools.

14. Anesthesiologist (tie)

Industry: Health care

Median Salary: >$208,000

Unemployment Rate: 0.5 percent

Important members of surgical teams, anesthesiologists work as human painkillers. They administer the drugs that reduce patient discomfort or put them temporarily to sleep during operations such as tooth extraction and heart surgery, as well as procedures related to giving birth. Precision is important to their work, because they’ve got to get the medication dose exactly right while monitoring vital signs like heart rate, blood pressure, breathing and body temperature.

Anesthesiologists need undergraduate and medical school degrees, plus years of residency experience and licenses to operate. Demand for these professionals is expected to increase 15.4 percent by 2026, adding 5,100 jobs.

Learn more about anesthesiologists.

Learn more about medical schools.

13. Occupational Therapist

Industry: Health care

Median Salary: $83,200

Unemployment Rate: 0.5 percent

If an injury or disability makes it difficult for you to get around, fulfill job duties, keep clean or interact with family and friends, you may benefit from the expertise of an occupational therapist. These health care professionals help people with physical limitations develop and maintain the skills they need for daily life.

Occupational therapists evaluate patients and help them successfully complete specific activities, sometimes with the use of special equipment like wheelchairs and braces. They develop treatment plans that focus both on adapting the environment to better accommodate patients’ needs and helping patients adapt to their environments.

Occupational therapists need master’s degrees and licenses. Employment is expected to increase by 23.8 percent by 2026, adding 31,000 jobs.

Learn more about occupational therapists.

9. Physician (tie)

Industry: Health care

Median Salary: $192,930

Unemployment Rate: 0.5 percent

This is a catch-all term for doctors of all varieties. Some physicians are internists whose work focuses on specific organ systems, including the liver, digestive tract or kidneys. For example, cardiologists are experts in heart health, while dermatologists focus on the skin. Other physicians work in family medicine, advising on common conditions such as minor injuries and infections and providing annual checkups. No matter their specialty, physicians may prescribe medicine, order and interpret tests and provide advice.

This career requires college and medical school degrees, plus completion of a residency program. Demand for physicians is expected to climb 14.6 percent by 2026, adding 7,300 jobs.

Learn more about physicians.

Learn more about medical school programs in internal medicine.

Learn more about medical school programs in primary care.

9. Prosthodontist (tie)

Industry: Health care

Median Salary: $185,150

Unemployment Rate: 0.9 percent

If you're missing a pearly white or several, a prosthodontist can help. These doctors of dentistry specialize in replacing missing teeth. To fill the gaps, they may turn to surgical techniques, like implanting a screw into the jawbone and adding a replacement tooth on top, or they may use products like caps, dentures, bridges or crowns.

These professionals attend college and dental school, then receive additional training. Demand for prosthodontists is expected to rise 19.1 percent by 2026, adding 200 jobs.

Learn more about prosthodontists.

9. Oral and Maxillofacial Surgeon (tie)

Industry: Health care

Median Salary: >$208,000

Unemployment Rate: 0.5 percent

Oral and maxillofacial surgeons tackle medical situations more complicated and intense than what orthodontists and dentists handle. They extract wisdom teeth and others from the gums, excise oral cancers, correct jaw defects and perform surgeries on people with cleft lips or palates. They may also do cosmetic procedures related to the mouth.

These mouth doctors need college and dental school degrees. They must also complete surgical residency programs. Demand for oral and maxillofacial surgeons is expected to increase 19.1 percent by 2026, adding 1,300 jobs.

Learn more about oral and maxillofacial surgeons.

9. Obstetrician and Gynecologist (tie)

Industry: Health care

Median Salary: >$208,000

Unemployment Rate: 0.5 percent

Storks get all the credit for the hard work obstetricians and gynecologists do bringing new life into the world. These doctors jump into action when pregnant women go into labor, preparing for and aiding with delivery. But that's not all they do. Obstetricians and gynecologists provide medical care to women throughout their lives, usually related to the reproductive system. Many women visit their OB-GYN doctors annually for regular physical checkups, birth control, cancer screenings and tests related to sexually transmitted diseases.

After earning undergraduate and medical school degrees, obstetricians and gynecologists need several years of residency training. The field is expected to add 3,400 more jobs by 2026, a 15.5 percent increase.

Learn more about obstetricians and gynecologists.

Learn more about medical school programs in women’s health.

8. Pediatrician

Industry: Health care

Median Salary: $172,650

Unemployment Rate: 0.5 percent

As the guardians of children's health, these doctors need extra patience to serve their young patients, who include infants, toddlers, children and teenagers. Pediatricians handle common health concerns such as ear infections, minor injuries, strep throat and puberty challenges. They also administer the many vaccines kids require.

Pediatricians complete college, then graduate from medical school and finish a residency program. By 2026, pediatrician employment is expected to increase 15.4 percent, creating 4,600 new jobs for these doctors.

Learn more about pediatricians.

Learn more about medical school programs in pediatrics.

7. Nurse Practitioner

Industry: Health care

Median Salary: $103,880

Unemployment Rate: 1.1 percent

In most states, these advanced nurses can perform many duties associated with doctors, including diagnosing disease, prescribing medicine, requesting medical tests and referring patients to specialists. Nurse practitioners may work with specific sets of patients, such as people with mental illness, children or older adults.

After completing college, nurse practitioners must earn master’s degrees and licenses. They work in hospitals, outpatient centers and doctors’ offices. There is high demand for this role, and it’s expected to increase by 36.1 percent – or 56,100 jobs – by 2026.

Learn more about nurse practitioners.

Learn more about nursing programs.

5. Nurse Anesthetist (tie)

Industry: Health care

Median Salary: $165,120

Unemployment Rate: 0.4 percent

Patients undergoing surgery benefit from the pain-killing prowess of nurse anesthetists. During procedures, they administer anesthesia while monitoring vital signs, like breathing, heart rate, blood pressure and body temperature, to ensure that patients remain safe.

Before applying to graduate programs, these health care professionals must have a year of clinical experience, typically working as registered nurses in critical care environments. Demand for nurse anesthetists is expected to grow 16.2 percent by 2026, adding 6,800 jobs.

Learn more about nurse anesthetists.

Learn more about nursing programs.

5. Orthodontist (tie)

Industry: Health care

Median Salary: >$208,000

Unemployment Rate: 0.9 percent

Orthodontists specialize in shifting crooked teeth and correcting misaligned bites. Tools of their trade include braces, retainers and spacers.

The path to the orthodontist chair passes through many educational institutions. After graduating from college, these professionals must complete dental school (another four years) and then a specialized orthodontist program (another three years). Then they need to earn state licenses. The payoff for all that work? High salaries and above-average work-life balance. By 2026, experts predict a 19.3 percent increase in demand for orthodontists, or 1,300 new jobs.

Learn more about orthodontists.

4. Dentist

Industry: Health care

Median Salary: $151,440

Unemployment Rate: 0.9 percent

Treating medical problems that arise in the mouth is the specialty of dental doctors. They use X-rays, exams and tools like drills to diagnose and care for issues such as cavities and gum disease.

These oral health care experts earn college degrees, then attend specialized graduate programs. They may work with other dentists or run their own practices while collaborating with dental hygienists. By 2026, demand for dentists is expected to increase 19.4 percent, creating 25,700 new jobs.

Learn more about dentists.

3. Physician Assistant

Industry: Health care

Median Salary: $104,860

Unemployment Rate: 0.8 percent

Physician assistants work closely with patients, performing duties that may include reviewing medical histories, conducting exams, diagnosing injury and disease, ordering tests, making prescriptions and administering treatment. As key players on a health care team, they collaborate with doctors and nurses in family and emergency medicine, plus surgery and psychiatry.

After college, these professionals typically earn master's degrees before finding work in hospitals and doctors’ offices. Demand for physician assistants is expected to increase dramatically by 37.3 percent by 2026, creating 39,600 new jobs.

Learn more about physician assistants.

Learn more about physician assistant programs.

2. Statistician

Industry: Business

Median Salary: $84,060

Unemployment Rate: 0.9 percent

When businesses and government agencies need help making sophisticated decisions and solving complicated problems, they turn to statisticians. These math whizzes gather data, then use theories, models and specialized software to predict outcomes.

College degrees and master's degrees are typical for statisticians, often in subjects such as mathematics, economics or computer science. They may specialize in fields like engineering or physics. Demand for statisticians is expected to increase by 33.8 percent by 2026, adding 12,600 jobs.

Learn more about statisticians.

1. Software Developer

Industry: Technology

Median Salary: $101,790

Unemployment Rate: 1.9 percent

For the second year in a row, software developer tops this list. That's thanks to how integral digital technology has become to our personal and professional lives. Software developers pay attention to both aesthetics and function as they create and fix applications and programs for computers and smartphones.

Software developers typically have college degrees in computer science or a related discipline. Employment opportunities in the field are soaring; they’re expected to increase by more than 30 percent by 2026. That means the creation of 255,400 jobs.

Learn more about software developers.

See Gallery

HIDE CAPTION

SHOW CAPTION

of

SEE ALL

BACK TO SLIDE

ADP/Moody’s reported Wednesday that the economy added a better-than-expected 156,000 private payrolls in July, rising 44,000 from June’s upwardly revised level. And increases in jobless claims have been sanguine: The four-week moving average for weekly unemployment claims declined following the Department of Labor’s most recent release Thursday.

More from Aol.com:

Study backs up Andrew Yang's claim about immigrants

Trump threatens new tariffs as U.S.-China trade tensions spike again

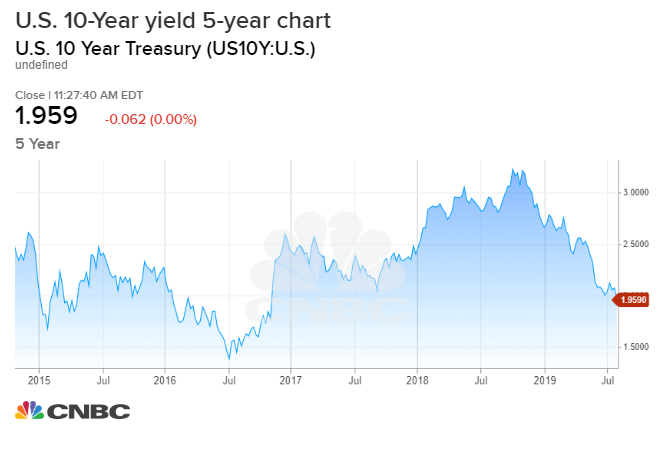

Federal Reserve cuts interest rate by 0.25 percent, marking first rate cut since 2008

https://www.aol.com/article/finance/2019/08/02/economy-adds-164000-jobs-in-july-unemployment-rate-37/23785189/

2019-08-02 12:39:50Z

52780344325116