https://www.cnn.com/2019/07/05/business/bmw-ceo-harald-krueger/index.html

2019-07-05 11:03:00Z

52780326927212

© Reuters.

© Reuters.

Investing.com - U.S. futures were lower on Friday as traders returned from the Fourth of July holiday to await the monthly employment report, something broadly expected to cement an interest rate cut from the Federal Reserve later in July.

fell 14 points or 0.2% by 6:40 AM ET (10:40 GMT), while slipped 29 points or 0.1% and inched down 4 points or 0.2%.

The is out at 8:30 AM ET (12:30 GMT) and analysts expect the creation of 160,000 jobs, up from 75,000 in May but still comfortably below the average monthly gain in 2018.

"There is a clear sense that the risks of making a policy error, by over-stimulating demand and creating inflation, appear to be low at this juncture," said Mark Dowding, chief investment officer with BlueBay Asset Management. "Therefore, it may require a jobs report adding more than 225k payrolls, plus evidence of higher wages and consumer prices, in order for the Fed to stand pat."

Markets have already priced in a cut of 25 basis points in July, with a 60% chance of three cuts by the end of the year.

Dowding noted that the political pressure to ease policy from President Donald Trump could also make it harder for the Fed to keep rates where they are.

Semiconductor makers were under pressure in premarket trading after Korean giant Samsung (KS:) said it expects second-quarter profit to have fallen dramatically. Micron Technology (NASDAQ:) fell 0.5%, while Qualcomm (NASDAQ:) was down 2.7% and Nvidia (NASDAQ:) down 0.2%

Tesla (NASDAQ:) rose 0.3% in premarket trading, while BMW (OTC:) ADRs, which hit a six-week high on Wednesday, were also in focus after CEO Harald Kruger announced his resignation amid reports that the company's supervisory board had lost confidence in him.

Amazon.com (NASDAQ:) is also in the spotlight, after the U.K.’s Competition and Markets Authority told the e-commerce giant to pause its integration with meal delivery service Deliveroo, while it decides whether or not to launch an investigation into a possible competition breach.

In commodities, fell 0.8% to $56.85 a barrel, while were down 0.3% to $1,416.55 a troy ounce. The , which measures the greenback against a basket of six major currencies, inched up 0.2% to 96.530.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Amazon must put the brakes on its potential tie-up with food delivery company Deliveroo, a UK competition regulator has ruled.

The UK watchdog, the Competition and Markets Authority (CMA), raised concerns this week that Amazon and Deliveroo had "ceased to be distinct" or that they could merge in the future. This would reduce customer choice in the market, which gives the CMA grounds to intervene in the business relationship. It issued an initial enforcement order limiting what changes can be made to the business and its relationship with Amazon.

Amazon was forced to close its own restaurant delivery service in the UK last year when it couldn't keep up with local counterpart Deliveroo. But never one to be outdone, Amazon decided this year to invest $575m in Deliveroo and became the company's largest backer.

For now, Deliveroo can continue delivering food in the UK, but it must operate as distinct company with its own sales and branding and not be subsumed under the Amazon brand. The ruling also forbids any "substantive changes" to the organizational structure of the business while the CMA decides if it should launch a full investigation.

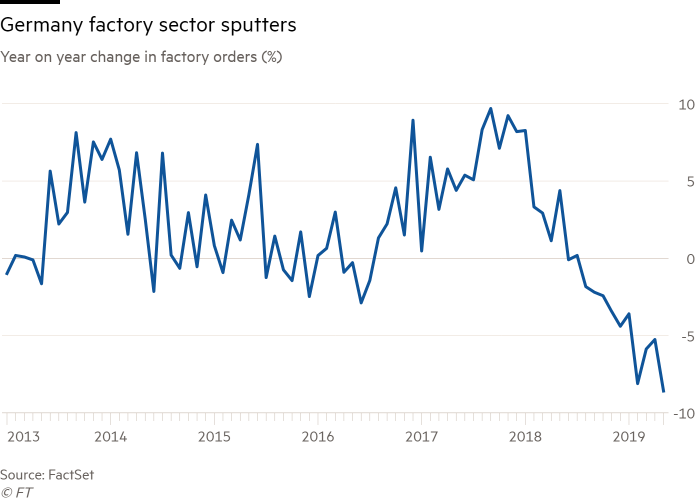

A key gauge of the health of Germany’s manufacturing industry sank by far more than expected in May, amid a steep drop-off in foreign demand that is hitting factories across the eurozone and raising expectations that the European Central Bank will revive its crisis-era stimulus.

Manufacturing orders in Germany dropped 2.2 per cent month-on-month in May, and were down 8.6 per cent from the same month in 2018. A Reuters poll of economists had forecast a fall of 0.1 per cent.

The publication of the data sparked a fresh fall in government borrowing costs as markets priced in the likelihood of more monetary easing from the ECB. Germany’s 10-year Bund yield traded near historic lows of minus 0.4 per cent on Friday, after the release of the data.

The global trade slowdown has dealt a severe blow to manufacturers in the single currency area, with Germany’s €1.6tn export machine being hit particularly hard. A poll of purchasing managers published this week suggested that levels of activity had continued to shrink in June.

“Today’s figures do not bode well for the short-term prospects for the German economy,” said Ralph Solveen, an economist at Commerzbank, who added that the report underlines “our expectation that the German economy shrank in the second quarter and that hopes of a noticeable improvement in the third are dwindling”.

The scale and duration of the problems have raised fears among policymakers that the woes of the region’s factories will begin to infect other parts of the economy, including the dominant services sector that is more reliant on domestic demand.

The wider economy has held up well in the face of the manufacturing slowdown; unemployment in Europe’s largest economy is close to post-reunification lows. But there are signs the German labour market is weakening, although the evidence is inconclusive.

Any increase in unemployment is likely to weigh on consumer spending.

Departing ECB president Mario Draghi is widely expected to launch fresh policy stimulus, including interest rate cuts and further bond purchases, during his final months in office. The bank’s governing council next meets on July 25.

“German factory orders have brought us closer to ECB action at the July meeting,” said Carsten Brzeski, economist at ING. “If industrial data next week are equally dreadful, it is hard to see the ECB not acting. Mr Draghi increased expectations so strongly that no reaction to another set of disappointing data would be counter-effective.”

In a sign of how far investors’ expectations of central bank action have shifted, the market value of negative-yielding debt globally this week reached a record high of $13tn, according to data from Barclays.

The figure represents a dramatic increase from $8.3tn at the end of last year. The negative yield means that investors who purchase the Bunds and hold them to maturity will receive less in repayment and regular coupon payments than their initial investment.

Germany’s factory sector has been among the hardest hit by the sharp slowdown in global trade stoked by the US-China trade war. Sluggish growth across some of its major trading partners, such as Turkey, has also weighed on what was until recently the eurozone’s economic powerhouse.

Foreign orders at German manufacturers slumped 4.3 per cent in May, on a month-over-month basis, according to surveys of purchasing managers. Orders from the eurozone were off 1.7 per cent, and those outside the bloc tumbled 5.7 per cent. Domestic orders rose 0.7 per cent.

“Manufacturers have, at least according to the PMIs, been able to maintain production growth in excess of the flow of new orders recently by clearing work backlogs,” said Claus Vistesen, chief eurozone economist at Pantheon Macroeconomics. “But that can’t go on indefinitely.”

U.S. stock index futures pointed to a slightly mixed open on Friday as investors focused on the release of key jobs data.

At 03:33 a.m. ET, Dow futures were down 11 points, implying a muted open. Futures on S&P 500 and Nasdaq traded in opposite directions.

Market focus is largely attuned to nonfarm payrolls and unemployment data, expected at 08:30 a.m. ET on Friday. Nonfarm payrolls are predicted to have risen by 160,000 in June, compared to 75,000 in May, according to a Reuters poll.

A weaker-than-expected figure could increase bets that the Federal Reserve will cut interest rates at its meeting on July 30 and 31. The central bank opened the door to easier monetary policy last month by stating it will "act as appropriate" to maintain the current economic expansion.

Meanwhile, geopolitical tensions in the Middle East continue to dominate after the British Royal Marines seized a large Iranian oil tanker Thursday for trying to take oil to Syria in violation of EU sanctions, evoking fury in Tehran.

Oil prices were mixed in morning trade, with the international benchmark Brent crude futures contract flat at $63.30 per barrel, while U.S crude futures slipped 1.01% to $56.76 per barrel.

The Huawei logo is pictured on the company's stand during the 'Electronics Show - International Trade Fair for Consumer Electronics' at Ptak Warsaw Expo in Nadarzyn, Poland, May 10, 2019. REUTERS/Kacper Pempel

NEW YORK (Reuters) - The U.S. government filed a motion on Wednesday asking for the dismissal of a lawsuit by Chinese telecommunications giant Huawei Technologies Co Ltd that claimed the United States had acted illegally when it blacklisted Huawei’s products.

Huawei sued the U.S. government in early March, in a complaint filed in federal court in Texas, saying that a law limiting its American business was unconstitutional.

The company has been a component of the ongoing trade war between the U.S. and China that has hung over financial markets, with President Donald Trump recently agreeing to loosen restrictions on Huawei after meeting with Chinese President Xi Jinping at the Group of 20 summit.

Top representatives of the two countries are organizing to resume talks next week, according to Trump administration officials.

On Wednesday, the U.S. government said that because the company was still blacklisted, license requests from U.S. companies seeking to import products to Huawei were being reviewed “under the highest national security scrutiny.”

The government’s motion was filed in U.S. District Court for the Eastern District of Texas, the same court where the original complaint was filed.

Huawei did not immediately return a request for comment.

Huawei Technologies USA, Inc., & Huawei Technologies Co., Ltd. v United States of America, et al., No. 4:19-cv-00159-ALM

Reporting by Chuck Mikolajczak; Editing by Leslie Adler

Kelly Tyko USA TODAY

Published 2:16 PM EDT Jul 4, 2019

Some DirecTV and AT&T U-verse subscribers woke up Thursday to find they lost access to Nexstar stations.

More than 120 stations in 97 markets across the nation, which include ABC, CBS, FOX, and NBC affiliate stations, went dark at 11:59 p.m. local time July 3 after Nexstar and AT&T were unable to reach an agreement, both sides said in competing statements that each blame the other for the blackout.

“Nexstar has removed its channels from your lineup even though we offered Nexstar more money to keep them available to you,” AT&T said in its statement posted at https://tvpromise.att.com. “Nexstar simply said no and elected to remove them from your lineups instead, putting you in the middle of its negotiations.”

According to Nexstar's statement, AT&T "unilaterally dropped the network and local community programming" and refused to extend the existing distribution agreement to Aug. 2.

Secrets and privacy: DNA testing can share all your family secrets. Are you ready for that?

Protect yourself: 4 chilling lessons from a tech hotline scam

Disputes between content providers and cable and satellite providers aren't uncommon as companies try to negotiate new deals.

In its statement, Nexstar, also known as Nexstar Broadcasting Group, says it owns, operates, programs or provides sales and other services to 174 full power television stations and related digital multicast signals reaching 100 markets or nearly 39% of all U.S. television households.

"Nexstar remains eager to complete an agreement with DIRECTV consistent with those it has made with every other cable, satellite and telco provider in order to end DIRECTV’s action that is both unnecessary and punitive to its subscribers," Nexstar's statement said.

AT&T, which is the largest pay TV provider in the U.S., with 24.5 million subscribers, said it also is open to negotiating.

"We share your frustration and are working to return your local channels as soon as possible," AT&T's statement said. "These types of disputes are often resolved quickly, and we hope that will be the case this time."

AT&T says subscribers who lost access have some options.

“Most of these stations can be viewed over the air or online at the station websites. You should be able to find station websites by searching online for the name of the local station,” AT&T said noting most major networks stream primetime series on websites and apps.

Nexstar offered additional options in its statement.

“Viewers affected by the loss of service from DIRECTV have several alternatives to continue watching their favorite shows including local cable providers, DISH, over-the-air, certain subscription streaming television services, and services such as Verizon’s FIOS,” Nexstar said.

Follow USA TODAY reporter Kelly Tyko on Twitter: @KellyTyko