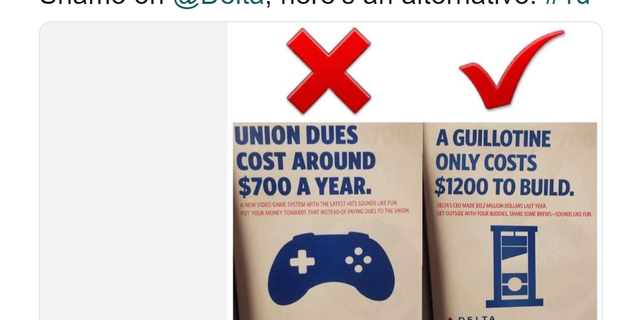

The AFL-CIO, the largest labor organization in the U.S., came under fire Thursday after tweeting a parody version of a real Delta Air Lines print ad that suggested that workers could find other uses for the $700 a year they would spend on union dues.

The parody ad suggests that the workers could instead spend $1,200 to build a guillotine -- perhaps implying that the device would be used on company executives.

The AFL-CIO tweet, which was later deleted, showed the two ads side-by-side, with a big red "X" over the real Delta ad and a big red check mark over the parody ad.

TRUMP BLASTS AFL-CIO BOSS AND TOUTS REBOUNDING ECONOMY IN SERIES OF LABOR DAY TWEETS

The AFL-CIO, the largest labor organization in the U.S., came under fire on Thursday after tweeting a picture of a guillotine and apparently threatening Delta CEO Ed Bastian after the company came out against unionization. (Twitter)

The tweet appeared to be aimed at Delta CEO Ed Bastian, after the company came out against efforts by the International Association of Machinists and Aerospace Workers to get certain Delta employees to unionize.

The AFL-CIO, which represents 12.5 million union workers, jumped to criticize Delta for opposing unionization and shared the ill-advised Twitter joke.

The tweet remained online for at least a couple of hours before it was deleted.

AFL-CIO spokeswoman Carolyn Bobb later told CNN that the labor organization didn’t make the image, having just found it on social media.

SPECIAL ED TEACHER SUING CALIFORNIA UNION IN CASE THAT COULD COST LABOR BIG

“We strive to keep our Twitter account actively engaging and real to advocate for working people,” she said. “We came across and shared this Internet meme. We realize it was in poor taste, that [it] doesn't reflect the values of the AFL-CIO and it has been taken down.”

“We came across and shared this Internet meme. We realize it was in poor taste, that [it] doesn't reflect the values of the AFL-CIO and it has been taken down.”

The picture of a guillotine came after social media circulated the anti-union flyer made by Delta, which featured a gaming controller and suggested the union fees might be better spent on gaming.

“Union dues cost around $700 a year. A new video game system with the latest hits sounds like fun. Put your money toward that instead of paying dues to the union,” Delta’s flyer read.

CLICK HERE TO GET THE FOX NEWS APP

Some have jumped to criticize Delta’s campaign against unionization, with U.S. Sen. Sherrod Brown, D-Ohio, calling it “condescending bulls---“ and noted that a gaming console won’t provide “fair wages” or “health care benefits.”

https://www.foxnews.com/us/big-labor-group-tweets-picture-of-guillotine-threatening-delta-ceo-for-opposing-unionization-efforts

2019-05-10 09:10:45Z

52780290590952