Minggu, 14 April 2019

World's largest airplane takes off - Guardian News

https://www.youtube.com/watch?v=_mNxyueL9i0

2019-04-14 11:32:11Z

52780267897770

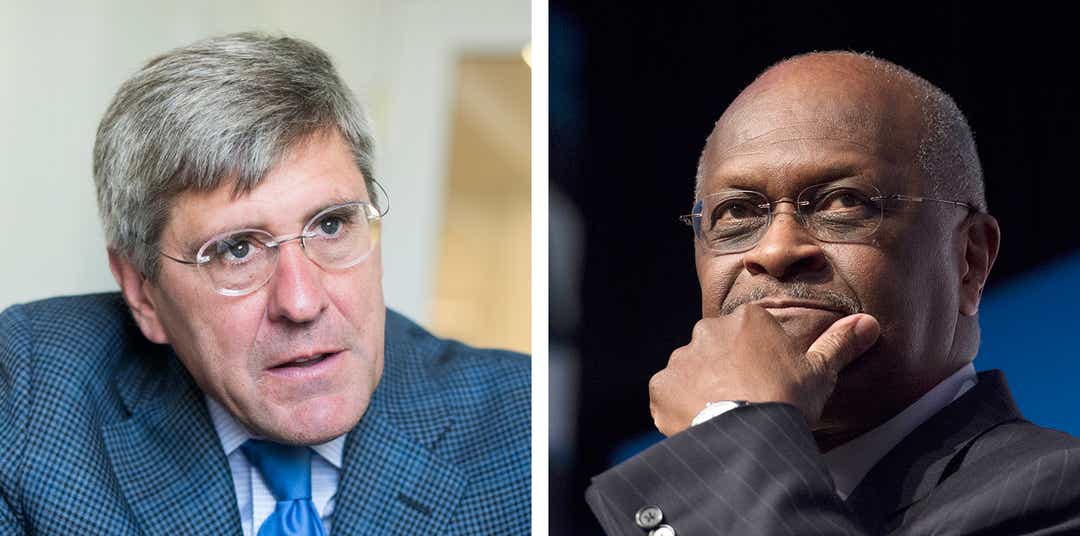

Why Donald Trump's Fed picks Stephen Moore and Herman Cain have caused such a ruckus - USA TODAY

Paul Davidson and Michael Collins USA TODAY

Published 7:41 AM EDT Apr 14, 2019

President Donald Trump’s selections for the Federal Reserve board, conservative pundit Stephen Moore and former pizza chain executive Herman Cain, have created a media firestorm. Cain, a Republican who ran for president in 2012, may be set to withdraw from consideration in the face of opposition from Senate Republicans, according to an ABC News report Friday, though Moore was still in the running.

Trump’s plans to nominate the two political allies followed his repeated criticism of the Fed for raising interest rates last year and his reported musings about whether he could fire Fed Chairman Jerome Powell.

USA Today reporters Paul Davidson Michael Collins break down why the potential nominations of Moore and Cain have caused such an uproar.

Trump has made many unorthodox picks for Cabinet and other posts. Why have these two generated such controversy?

Simply put, the Fed is a different species than, say, the Department of Education or Environmental Protection Agency. It’s an independent agency that has a long tradition of remaining insulated from politics so it can do what’s best for the economy. The Fed lowers interest rates to stimulate a sluggish economy and raises rates to head off excessive inflation. A hike in rates makes mortgages and other loans more expensive for consumers and businesses, crimping economic growth. But the goal is to prevent runaway inflation down the road that could plunge the economy into recession.

“It may have to make unpopular choices, such as raising interest rates,” says Tim Duy, economics professor at the University of Oregon and author of the FedWatch blog.

And that “may not be in the best interest of the political party” in power, says Peter Conti-Brown, a professor of legal studies and business ethics at the Wharton School in Philadelphia and author of "The Power and Independence of the Federal Reserve."

Why are critics of Moore and Cain saying they are ill-suited for nonpartisan roles?

Both Moore and Cain opposed the Fed’s easy-money, low-rate policies under President Barack Obama even though most economists said such an approach was necessary to pull the nation out of the worst downturn since the Great Depression. Yet both recently supported Trump’s calls to cut rates, or at least not raise them, despite a much-improved economy and moderately higher inflation.

“Their goal is to take the anti-Democrat position in all states of the economy,” Duy says.

Conti-Brown was especially troubled that Cain suggested during his 2012 presidential bid that strong job growth numbers that year were cooked by the Labor Department to help Obama’s reelection chances.

“He has been willing to traffic in conspiracy theories,” Conti-Brown says, adding that casting doubt on the integrity of the government’s economic data is a dangerous tactic that can undercut consumer and business confidence.

Has the Fed always been isolated from politics?

Presidents have routinely picked members of their own party for Fed board seats. That has sometimes led to Democratic Fed officials who are more inclined to spur growth and Republicans more concerned about inflation, though those distinctions have blurred in recent years, Conti-Brown says. For the most part, both Republican and Democratic Fed policymakers are technocrats working to achieve the best balance for the economy, Duy says.

Since the Clinton administration, U.S. presidents have generally steered clear of trying to influence Fed decisions. Trump has broken with that tradition.

But prior to the Clinton years, "presidents regularly talked about Fed policy,” says Nomura economist Lewis Alexander, a former Fed official.

President Lyndon Johnson was furious when the Fed ignored his wishes and raised the discount rate in 1965. He brought Fed Chairman William McChesney Martin to his Texas ranch, took him for a ride in a jeep and then berated him for the rate hike.

And President Richard Nixon, worried that a recession would hurt his reelection chances in 1972, pressured Fed chief Arthur Burns to lower interest rates. The Fed’s key rate fell sharply from 1970 to 1972, juicing the economy but eventually sparking high inflation. It’s unclear if Burns acted to heed Nixon’s plea or to bolster the economy.

More: Bed Bath & Beyond plans to close at least 40 stores this year but open 15 new locations

More: Forget the dream wedding. Gen Z-ers are planning to own homes before they're 30, survey finds

Aside from their political leanings, are Moore and Cain qualified to serve on the Fed’s board?

Both Duy and Conti-Brown say no. While many Fed board members have PhDs in economics and deep professional or academic backgrounds, others such as current Fed Chairman Powell, do not. Yet those Fed officials typically have had other significant related experience, such as in banking, Conti-Brown says.

Moore, who has a master of arts in economics, has been a fellow at conservative think tanks such as the Heritage Foundation and Cato Institute and co-founded the Club for Growth, which advocates tax cuts. He advised Cain in his 2012 presidential campaign and Trump in his 2016 run and regularly appears on TV in support of Trump’s policies.

Cain rose through the ranks at companies such as Burger King and Pillsbury before becoming CEO at Godfathers Pizza. He served as a director of the Federal Reserve Bank of Kansas City from 1992 to 1996 in the roles of deputy chairman and then chairman of the board but Duy doesn’t believe that qualifies him to serve on the Fed's board. The boards of regional Fed banks are often made up of business executives, not monetary policy experts.

Both Moore and Cain have called for the United States to return to the gold standard, which would restrict the Fed’s ability to adjust interest rates.

Conti-Brown added he's "very uncomfortable" about the sexual harassment allegations against Cain that forced to drop out of the 2012 race. Cain has denied the claims.

Have Trump’s other Fed nominees raised these sorts of concerns?

No. The three current board members Trump has appointed all have deep credentials and experience in economics, including high-level positions in the Treasury Department or banking. Trump himself elevated Powell -- a former Treasury official, lawyer and investment banker -- from Fed board member to chairman but has since soured on him because of the rate hikes.

Why is Trump taking a different approach with these two nominees?

Duy says Trump was frustrated by the Fed’s four rate hikes last year and so “now picks people he thinks will be more pliable.”

Michael Bardo, director of the Center for Monetary and Financial History at Rutgers University, says Trump is worried a recession in 2019 or 2020 could doom his reelection chances and wants to appoint Fed officials who will push growth-enhancing policies.

“He’s thinking like Nixon,” Bordo says. “Nixon was really paranoid about a recession.”

Could Moore and Cain steer Fed policy in the direction Trump wishes if confirmed by the Senate?

Almost certainly not. They “would be two voices on a (policymaking) committee of 19” that includes seven Fed board members and 12 regional Fed bank presidents, says Barclays economist and former Fed staffer Michael Gapen.

Duy, however, said Moore and Cain could affect the Fed’s internal debate about monetary policy and muddy its efforts to communicate more clearly to the public.

And Conti-Brown says their elevation to the board could set a precedent that makes future presidents more willing to move away from the tradition of picking technocrats to sit on the Fed board.

https://www.usatoday.com/story/money/2019/04/14/herman-cain-stephen-moore-fed-picks-trump-raising-uproar/3447761002/

2019-04-14 11:01:00Z

CAIiEAz2h4rtnh9QzkncLl9IAh4qGQgEKhAIACoHCAowjsP7CjCSpPQCMM_b5QU

'World's largest plane' takes to the air - BBC News - BBC News

https://www.youtube.com/watch?v=2J7K2Umbh38

2019-04-14 10:33:24Z

52780267897770

Plane with the largest wingspan in the world takes flight - BBC News

The world's largest aeroplane by wingspan has taken to the air over the Mojave desert in California.

The aircraft built by Stratolaunch is designed to act as a flying launch pad for satellites.

Its wingspan measures 385ft (117m) and on its maiden flight the jet reached speeds of about 170mph (274km/h).

https://www.bbc.com/news/av/world-us-canada-47924204/plane-with-the-largest-wingspan-in-the-world-takes-flight

2019-04-14 08:12:48Z

52780267897770

Plane with the largest wingspan in the world takes flight - BBC News

The world's largest aeroplane by wingspan has taken to the air over the Mojave desert in California.

The aircraft built by Stratolaunch is designed to act as a flying launch pad for satellites.

Its wingspan measures 385ft (117m) and on its maiden flight the jet reached speeds of about 170mph (274km/h).

https://www.bbc.com/news/av/world-us-canada-47924204/plane-with-the-largest-wingspan-in-the-world-takes-flight

2019-04-14 07:12:22Z

52780267897770

Sabtu, 13 April 2019

Facebook investors launch desperate bid to oust Mark Zuckerberg - Mashable

The call to oust Mark Zuckerberg is coming from inside the house.

A group of investors have teamed up in an effort to replace the Facebook CEO and board chairman with an independent voice. The plan, put forth in an April 12 SEC filing, doesn't mince words in its critique of the 34-year-old fan of smoked meats.

"[Zuckerberg's] dual-class shareholdings give him approximately 60% of Facebook's voting shares, leaving the board, even with a lead independent director, with only a limited ability to check Mr. Zuckerberg's power," reads the statement supporting the proposal. "We believe this weakens Facebook's governance and oversight of management."

In other words, even Facebook investors think an unchecked Zuckerberg is bad for business. And in case that wasn't clear enough, they lay out a few examples demonstrating, in their view, how miserably he's screwed things up.

"We believe this lack of independent board Chair and oversight has contributed to Facebook missing, or mishandling, a number of severe controversies, increasing risk exposure and costs to shareholders," the proposal reads.

It goes on to provide the following examples: "Russian meddling in U.S. elections," "Sharing personal data of 87 million users with Cambridge Analytica," "Data sharing with device manufacturers, including Huawei that is flagged by U.S. Intelligence as a national security threat," "Proliferating fake news," "Propagating violence in Myanmar, India, and South Sudan," "Depression and other mental health issues, including stress and addiction," and "Allowing advertisers to exclude black, Hispanic, and other 'ethnic affinities' from seeing ads."

The plan, if adopted, would make "the Chair of the Board of Directors, whenever possible, be an independent member of the Board."

Unsurprisingly, Facebook isn't a fan. The company dismissed the need for an independent board chairperson, before reminding the investors in question that they don't really have the votes to pull off this maneuver.

"In addition," writes Facebook, "our stockholders rejected a similar proposal at our annual meeting of stockholders in 2017."

Even though this specific attempt to pull Zuckerberg's board chairmanship out from under him is destined to fail, the fact that it's a recurring effort sends a warning of looming accountability to the CEO. If not today, then tomorrow. Time will tell if he listens.

https://mashable.com/article/facebook-investors-attempt-oust-zuckerberg/

2019-04-13 19:18:00Z

52780267494802

Group asks gov't to probe Nissan automatic emergency braking - 10TV

DETROIT — A U.S. auto safety group wants the government to investigate automatic emergency braking on some Nissan Rogue SUVs, alleging that the safety feature makes the vehicles brake even when there's no emergency.

The nonprofit Center for Auto Safety filed a petition with the National Highway Traffic Safety Administration seeking the probe. The group says about 675,000 Rogues from the 2017 and 2018 model years should be recalled.

Nissan says it has notified all customers of a software update that improves the performance of the automated braking system. But the center says the campaigns don't acknowledge the seriousness of the safety problem and give owners little incentive to get the SUVs fixed.

Advertisement - Story continues below

In a letter posted Friday by the government, center Executive Director Jason Levine says it found 87 complaints about unintended braking in the safety administration's database. "Many complaints indicate that braking is abrupt or forceful, endangering both the Rogue occupants as well as people in the vehicles nearby who are forced to avoid a collision with a suddenly stopped vehicle," the letter says.

Automatic emergency braking uses cameras and radar to slow or stop vehicles when drivers don't take action. The technology has great potential to save lives, but it also can develop glitches. Twenty automakers representing 99 percent of U.S. new-car sales signed a voluntary agreement with the government to make the feature standard on all light vehicles by Sept. 1, 2022.

In its petition, the center said that according to the complaints, the Nissan braking system can be triggered by railroad tracks, traffic lights, bridges, parking structures "and other fixed objects that do not pose a threat to the vehicle."

In an email, Levine said a recall is needed rather than Nissan's service campaign because false activation of the braking system is a safety hazard. He wrote that some drivers are turning off the technology because of the problem.

NHTSA said in documents that it will evaluate whether to grant or deny the center's petition. Safety advocates and vehicle owners can petition the government to open safety investigations.

Nissan said it will continue to work with NHTSA and Canadian safety regulators on all matters of product safety.

https://www.10tv.com/article/group-asks-govt-probe-nissan-automatic-emergency-braking-2019-apr

2019-04-13 17:20:43Z

52780267743569