Home Depot shares tumbled Tuesday after the company once again cut its 2019 forecast, and also reported same-store sales well below estimates.

The company said revenue, which also missed analysts' targets, was hurt by investments it is making in its business. Earnings came in a penny better than expected.

Shares of Home Depot were down about 5% in premarket trading.

Here's what the company reported compared with what Wall Street was expecting, based on a survey of analysts by Refinitiv:

- Earnings per share: $2.53, adjusted, vs. $2.52 expected

- Revenue: $27.22 billion vs. $27.53 billion expected

- Same-store sales growth, global: 3.6% vs. 4.7% expected

Home Depot said earnings fell to $2.8 billion, or $2.53 per share, from $2.9 billion, or $2.51 per share, a year ago. Analysts had expected the company to earn $2.52 per share.

Sales increased 3.5% to $27.22 billion, just shy of analysts estimates of $27.53 billion.

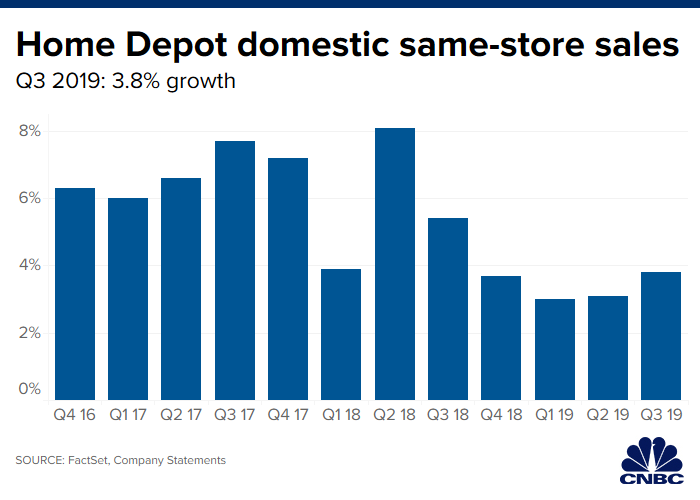

Sales at U.S. stores open at least 12 months rose 3.8%. Analysts were expecting a 4.7% gain.

Home Depot also cut its sales forecast for the year. It said it now expects sales to grow by 1.8%, down from a prior estimate of 2.3%. The company also cut its same-store sales forecast for the fiscal year. It now expects growth of 3.5%, compared with an earlier forecast of 4%.

Home Depot said its average customer ticket in the third quarter was $66.36, which was higher than it saw in the year ago quarter. Sales per square foot also rose to $449.17 from the year-ago period.

Last quarter, the Atlanta-based company trimmed its full-year revenue outlook, partially due to potential tariff impacts. It estimated the Dec. 15 tariffs and the 25% tariffs already in place could raise its cost of sales by about $2 billion, or about 2% of annual sales.

Home Depot CEO Craig Menear also cited continued lumber deflation for the lower sales forecast.

Rival Lowe's is slated to report its earnings before the bell on Wednesday. Shares of Home Depot hit a 52-week high on Monday of $239.31. The stock, which is valued at $262 billion, has risen 39% as of Monday's close. Rival Lowe's, which has a market value of nearly $89 billion, has gained 24% year to date.

Read the full press release here.

Correction: An earlier version of this story misstated the forecast for global same-store sales. Analysts were predicting a gain of 4.7%.

https://www.cnbc.com/2019/11/19/home-depot-earnings-q3-2019.html

2019-11-19 10:55:00Z

52780439152414

Tidak ada komentar:

Posting Komentar